start_date <- "2010-01-01"

end_date <- Sys.Date()

# Get data from Yahoo Finance

getSymbols("^GSPC", src = "yahoo",

from = start_date,

to = end_date,

auto.assign = TRUE) %>% invisible()Activity51

Ethical Considerations in Time Series Analysis

# Extract Adjusted Close prices and convert to tsibble

sp500_ts_scratch <- GSPC %>%

Ad() %>% # Select Adjusted Close column

`colnames<-`("Adjusted_Close") %>% # Rename column

fortify.zoo(names = "Date") %>% # Convert zoo object to data frame

as_tsibble(index = Date) %>%

# Calculate log returns

mutate(Log_Return = difference(log(Adjusted_Close))) %>%

drop_na(Log_Return) %>%

fill_gaps(.full = TRUE) %>%

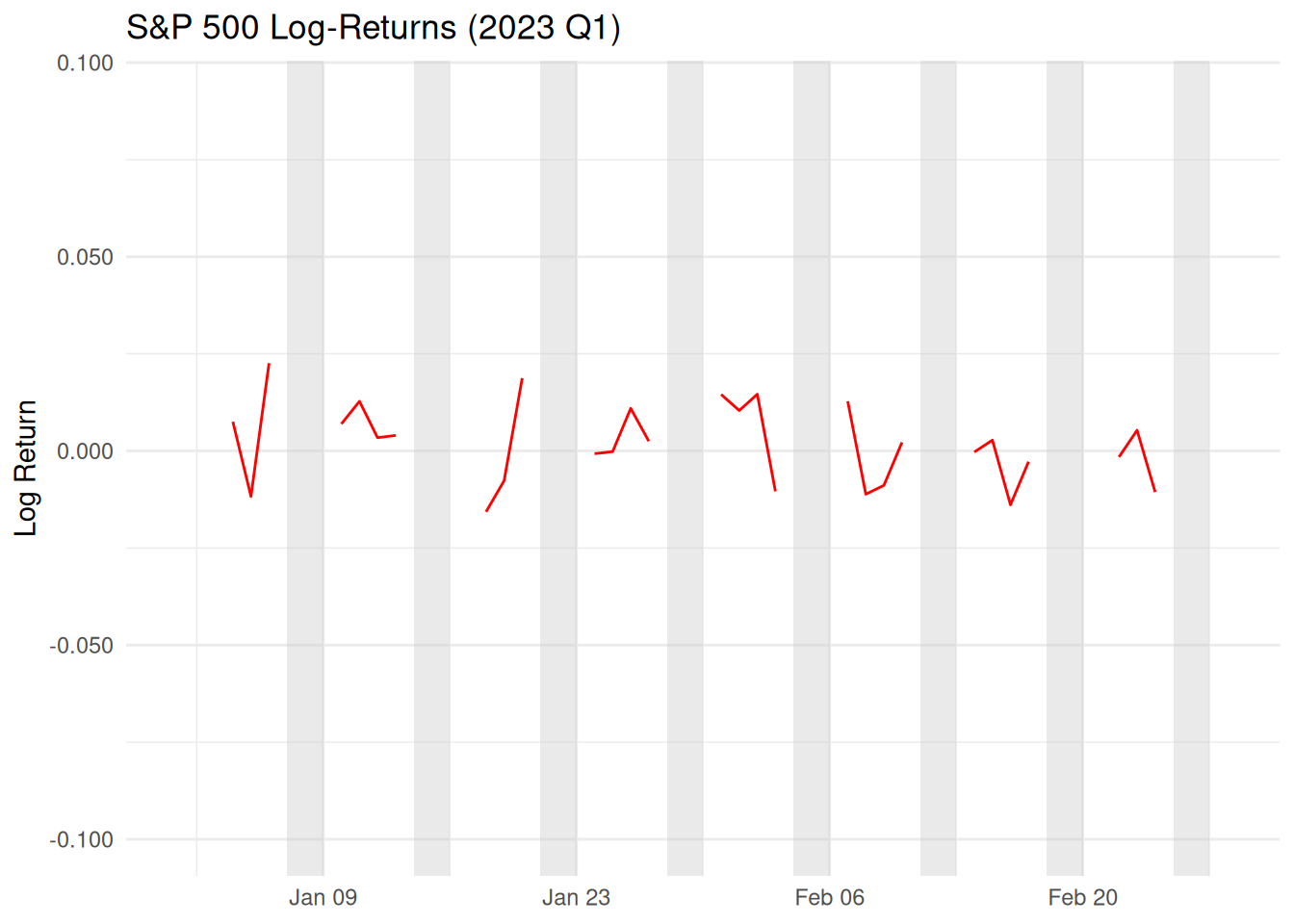

mutate(Log_Return = na.approx(Log_Return)) 1. Data Integrity & Transparency

1.1 The Myth of Complete Data

Concept: All real-world time series contain gaps/imputation needs

Example: S&P 500 data:

sp500_ts <- GSPC %>%

Ad() %>%

`colnames<-`("Adjusted_Close") %>% # rename

fortify.zoo(names = "Date") %>% # to data.frame

as_tsibble(index = Date) %>% # to tsibble

fill_gaps() %>% # explicit missing days

mutate(Adjusted_Close = na.approx( # interpolate prices

Adjusted_Close, rule = 2 # rule=2: carry ends

)) %>%

mutate(Log_Return = difference(log(Adjusted_Close))) sp500_ts_scratch <- GSPC %>%

Ad() %>% # Select Adjusted Close column

`colnames<-`("Adjusted_Close") %>% # Rename column

fortify.zoo(names = "Date") %>% # Convert zoo object to data frame

as_tsibble(index = Date) %>%

mutate(Log_Return = difference(log(Adjusted_Close))) Ethical Implications:

- 🚨 Silent imputation creates false continuity

- 📉 Hidden assumptions about market behavior

- 💡 Always report gap treatment methods (use

imputeTS::na_ma()as alternative)

Visual Evidence:

sp500_ts_plot <- GSPC %>%

Ad() %>% `colnames<-`("Adjusted_Close") %>% # rename

fortify.zoo(names="Date") %>%

as_tsibble(index=Date) %>%

fill_gaps() %>%

mutate(Log_Return = log(Adjusted_Close) - log(lag(Adjusted_Close)))

weekend_periods <- sp500_ts_plot %>%

distinct(Date) %>%

filter(wday(Date) %in% c(1,7)) %>% # Sunday=1, Saturday=7

arrange(Date) %>%

mutate(grp = cumsum(c(1, diff(as.numeric(Date)) != 1))) %>%

group_by(grp) %>%

summarise(

start = min(Date), # start at Sat midnight

end = max(Date) + days(1) # end at Mon midnight

) %>%

ungroup()

library(scales)

ggplot(sp500_ts_plot, aes(Date, Log_Return)) +

# (your weekend‐shade / rug / line layers here)

geom_rect(

data = weekend_periods,

aes(xmin = start, xmax = end, ymin = -Inf, ymax = Inf),

inherit.aes = FALSE, fill = "grey80", alpha = 0.4

) +

geom_line(color = "red", na.rm = TRUE) +

# 1. Restrict x-axis to Jan 1 2023 – Feb 28 2023

scale_x_date(

limits = as.Date(c("2023-01-01","2023-02-28")),

date_breaks = "2 weeks",

date_labels = "%b %d"

) +

# 2. Force plain numeric y labels (no 1e-notation) with three decimals

scale_y_continuous(

labels = number_format(

accuracy = 0.001,

big.mark = ",",

decimal.mark = "."

)

) +

labs(

title = "S&P 500 Log-Returns (2023 Q1)",

x = NULL,

y = "Log Return"

) +

theme_minimal()

# --- Get US Unemployment Rate Data from FRED ---

start_date <- "1948-01-01"

end_date <- Sys.Date()

# Get data (UNRATE is the series ID for Civilian Unemployment Rate, Seasonally Adjusted)

getSymbols("UNRATE",

src = "FRED",

from = start_date,

to = end_date,

auto.assign = TRUE) %>% invisible()# Convert to tsibble

unrate_ts <- UNRATE %>%

fortify.zoo(names = "Date") %>% # Convert zoo to data frame

# Ensure Date is Date class, create yearmonth index

mutate(Month = yearmonth(Date)) %>%

# Declare tsibble object

as_tsibble(index = Month) %>%

# Select relevant columns (rename UNRATE)

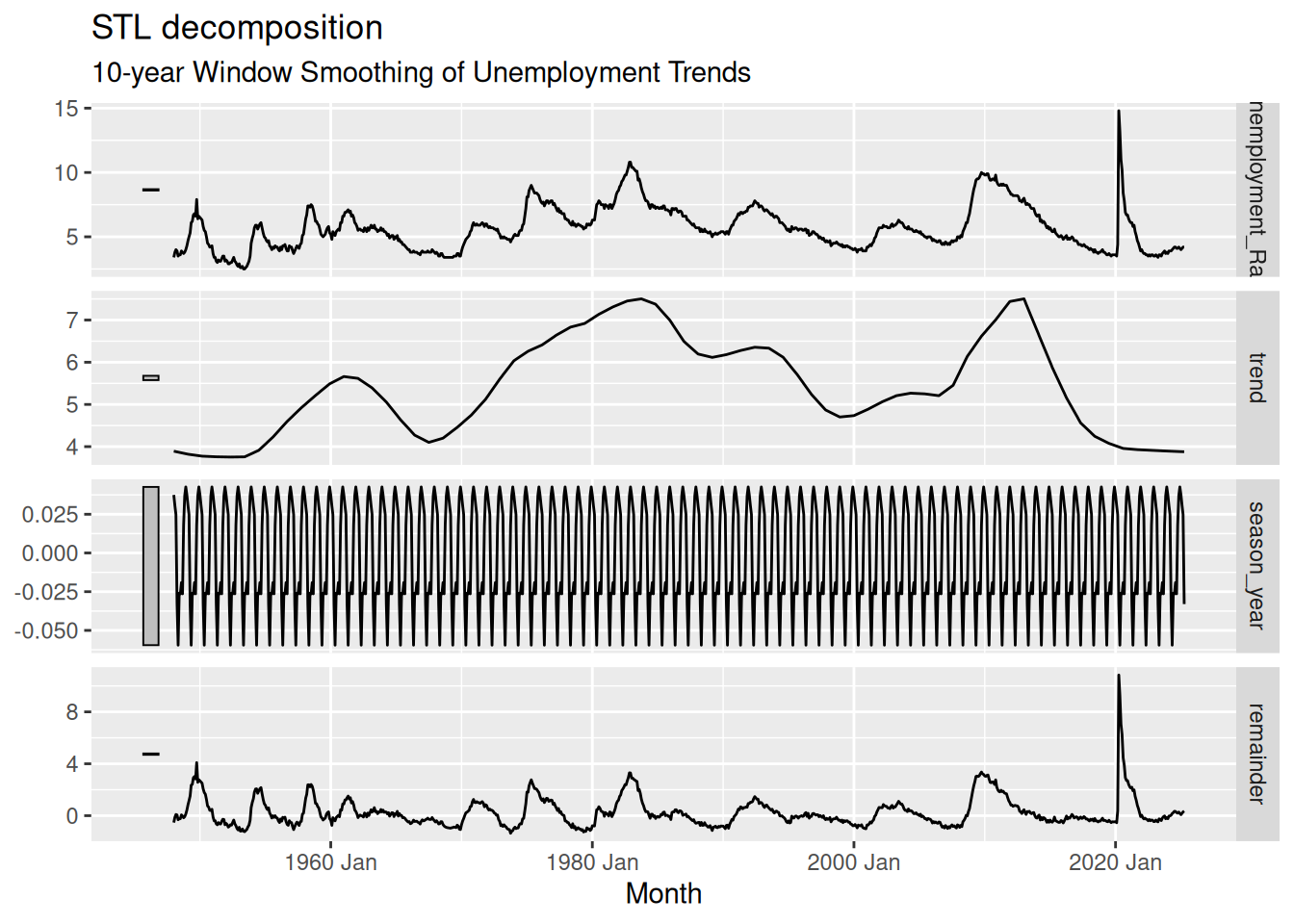

select(Month, Unemployment_Rate = UNRATE)1.2 Seasonality Manipulation

Concept: Seasonal adjustment choices impact policy decisions

Example: Unemployment Rate STL:

stl_decomp_unrate <- unrate_ts %>%

model(

stl_decomp = STL(Unemployment_Rate ~ trend(window = 121) +

season(window = "periodic"),

robust = TRUE)

) %>%

components() Ethical Risks:

- 🔍 Window size (121 months) smooths business cycles

- 📈 Different windows alter recession interpretations

- 💡 Document parameter sensitivity using

fabletools::refit()

Visual Proof:

stl_decomp_unrate %>%

autoplot() +

labs(subtitle="10-year Window Smoothing of Unemployment Trends")

2. Model Accountability & Impact

2.1 Assumptions and Errors

Concept: Each transformation propagates errors

Case Study: Log Returns Pipeline:

library(imputeTS)

sp500_clean <- sp500_ts %>%

# Remove non-trading days (weekends/holidays)

filter(!is.na(Adjusted_Close)) %>%

# Calculate log returns on valid trading days

mutate(Log_Return = difference(log(Adjusted_Close))) %>%

# Fill only actual trading day gaps (rare cases like exchange closures)

fill_gaps(.full = FALSE) %>%

# Ethical imputation with constraints

mutate(

Log_Return = na_locf(Log_Return, maxgap = 1) %>% # Carry forward 1 day

na_kalman() %>% # State-space imputation

na.omit() # Remove leading NA

)Ethical Chain:

- Logarithmic compression hides volatility scale

- Linear interpolation assumes market continuity

- Smoothing erases flash crash evidence

Solution: UseimputeTS::na_kalman()for state-aware imputation

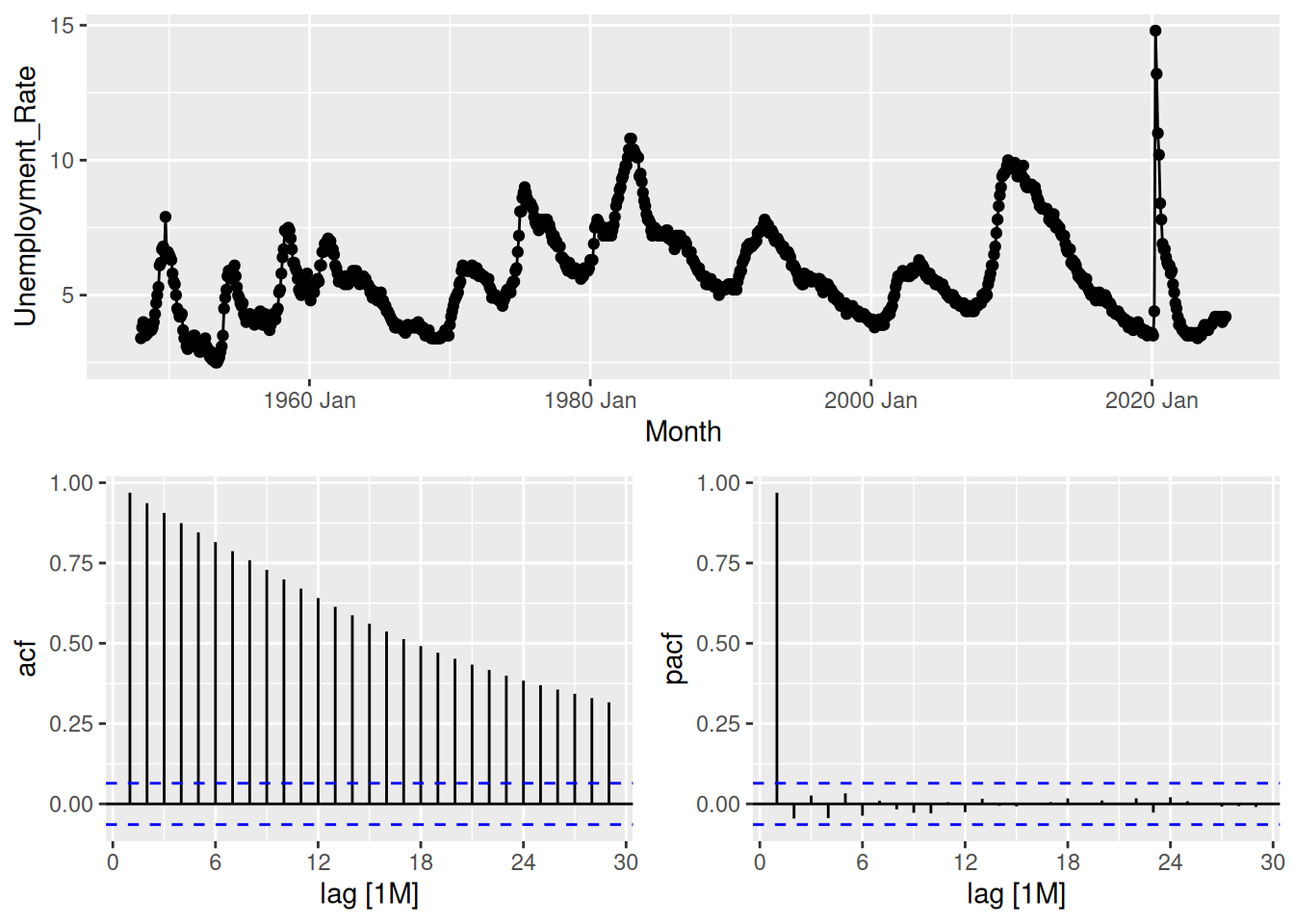

2.2 Non-Stationarity

Concept: Persistent series create false narratives

Unemployment ACF Analysis:

unrate_ts %>% gg_tsdisplay(Unemployment_Rate, plot_type="partial")

Dangers:

- Slow ACF decay (ρ₁=0.98) suggests structural persistence

- Mistaking hysteresis for mean-reversion

- 💣 Policy models might assume reversibility incorrectly

Remedies:

unrate_ts %>%

features(Unemployment_Rate, unitroot_kpss) %>%

knitr::kable(caption="Stationarity Test Results")| kpss_stat | kpss_pvalue |

|---|---|

| 0.9870803 | 0.01 |

2.3 Temporal Aggregation Bias

Concept: Frequency choices shape narratives

Contrast:

# Daily vs Monthly Returns

sp500_daily <- sp500_ts %>% index_by(Date)

sp500_monthly <- sp500_ts %>% index_by(Month=yearmonth(Date)) %>%

summarise(Volatility = sd(Log_Return, na.rm=TRUE))Ethical Dimensions:

- 📅 Daily data shows volatility clusters

- 📆 Monthly aggregates hide flash crashes

- 💡 Use

tsibble::index_by()consciously

Ethical Framework Checklist

ethical_checklist <- tibble(

Step = c("Data Collection", "Gap Treatment", "Transformation",

"Model Selection", "Interpretation"),

Questions = c(

"Source transparency?",

"fill_gaps()/na.approx() documentation?",

"Log/Sqrt transforms justified?",

"Parameter sensitivity tested?",

"Uncertainty intervals provided?")

)

knitr::kable(ethical_checklist)| Step | Questions |

|---|---|

| Data Collection | Source transparency? |

| Gap Treatment | fill_gaps()/na.approx() documentation? |

| Transformation | Log/Sqrt transforms justified? |

| Model Selection | Parameter sensitivity tested? |

| Interpretation | Uncertainty intervals provided? |

Activities

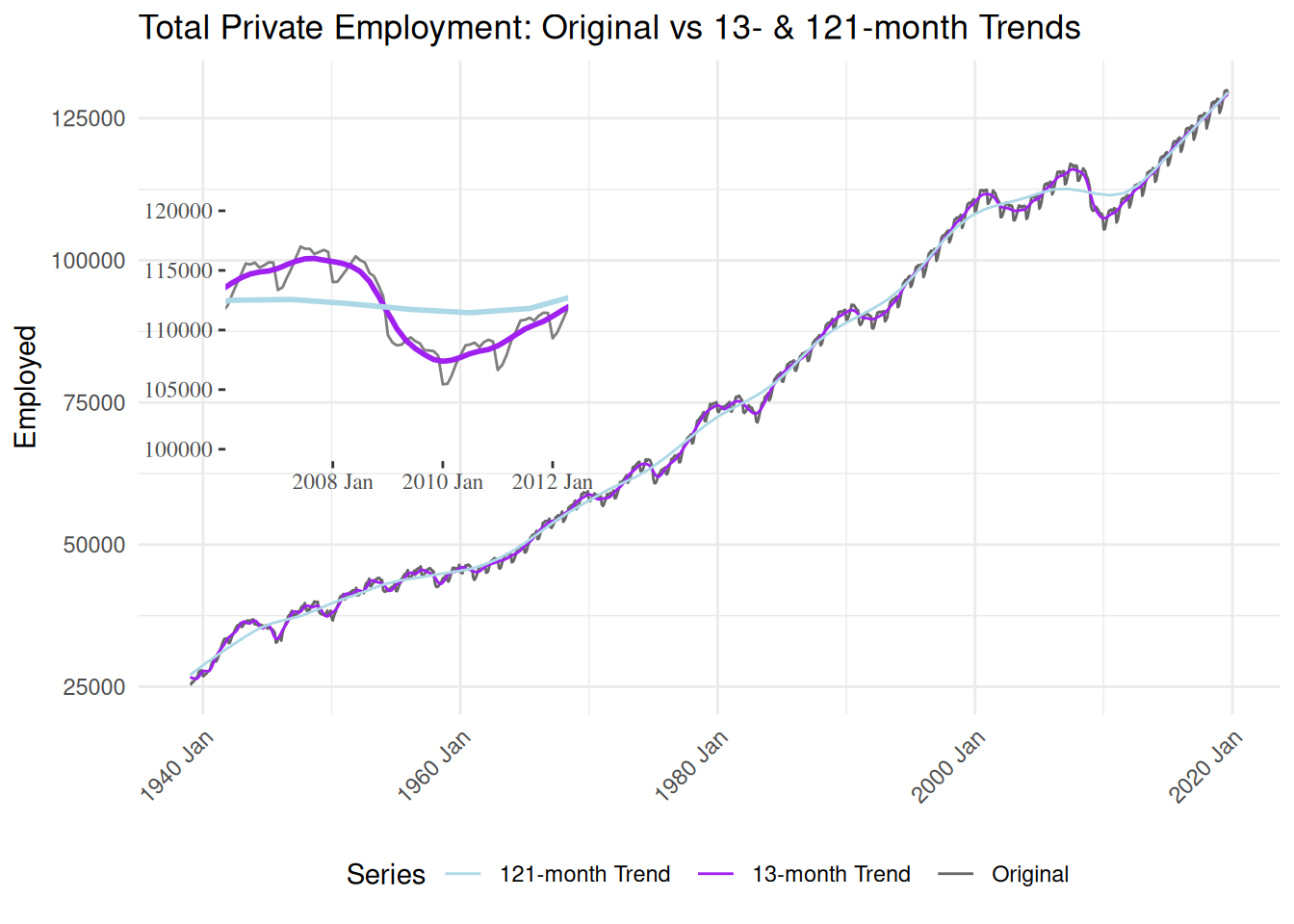

Seasonality Manipulation & Model Sensitivity on us_employment

1.1 STL Window‐Choice and Its Policy Implications

# 1. Prepare series

empl_ts <- us_employment %>%

filter(Title == "Total Private") %>%

select(Month, Employed) %>%

as_tsibble(index = Month)

# 2. Fit two STLs with different season windows

stl_short <- empl_ts %>% model(STL(Employed ~ trend(window=13) + season(window="periodic")))

stl_long <- empl_ts %>% model(STL(Employed ~ trend(window=121) + season(window="periodic")))

decomp_short <- components(stl_short)

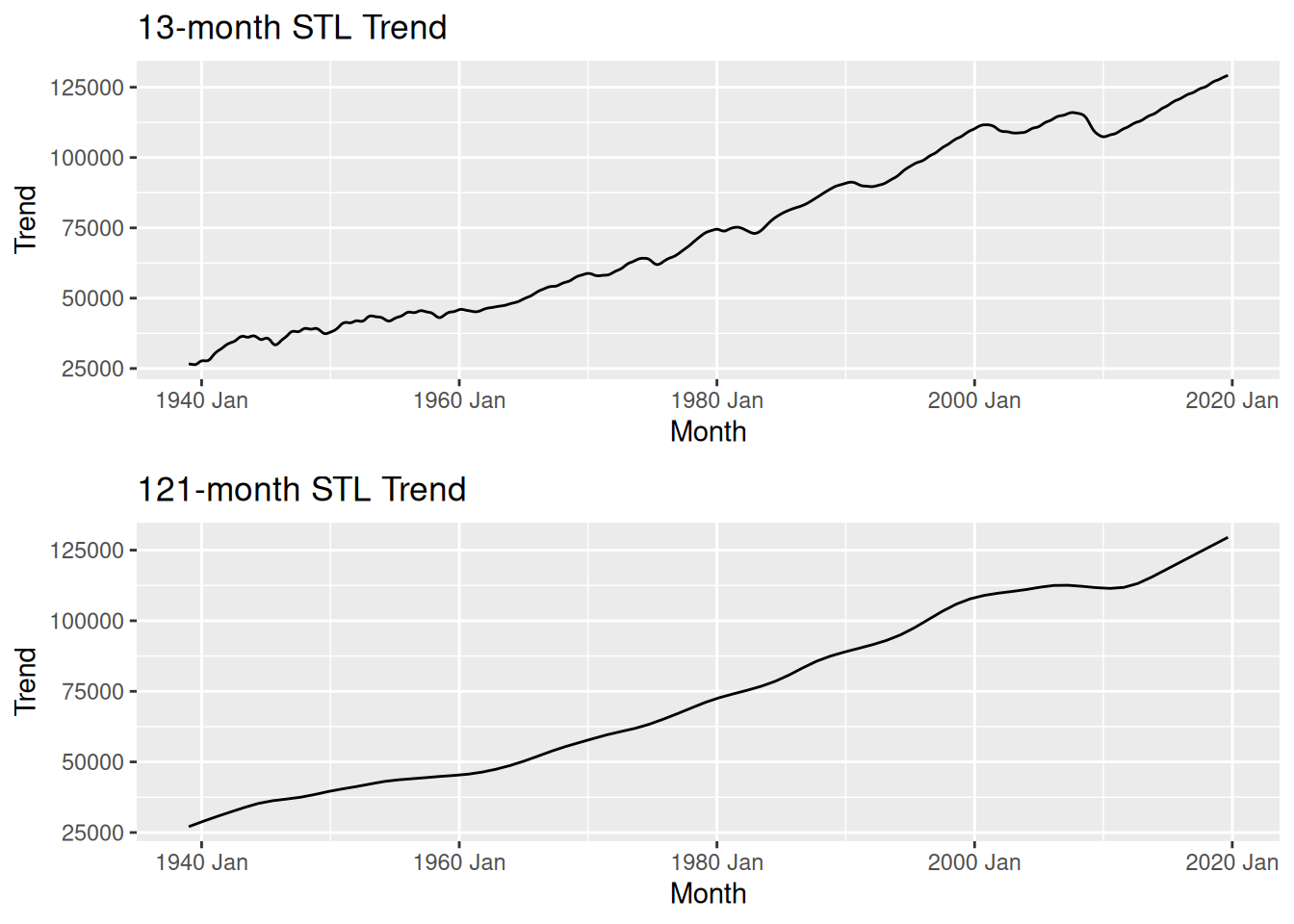

decomp_long <- components(stl_long)Tasks

1. Plot the two trend components side by side (use autoplot(decomp_… , series="trend")).

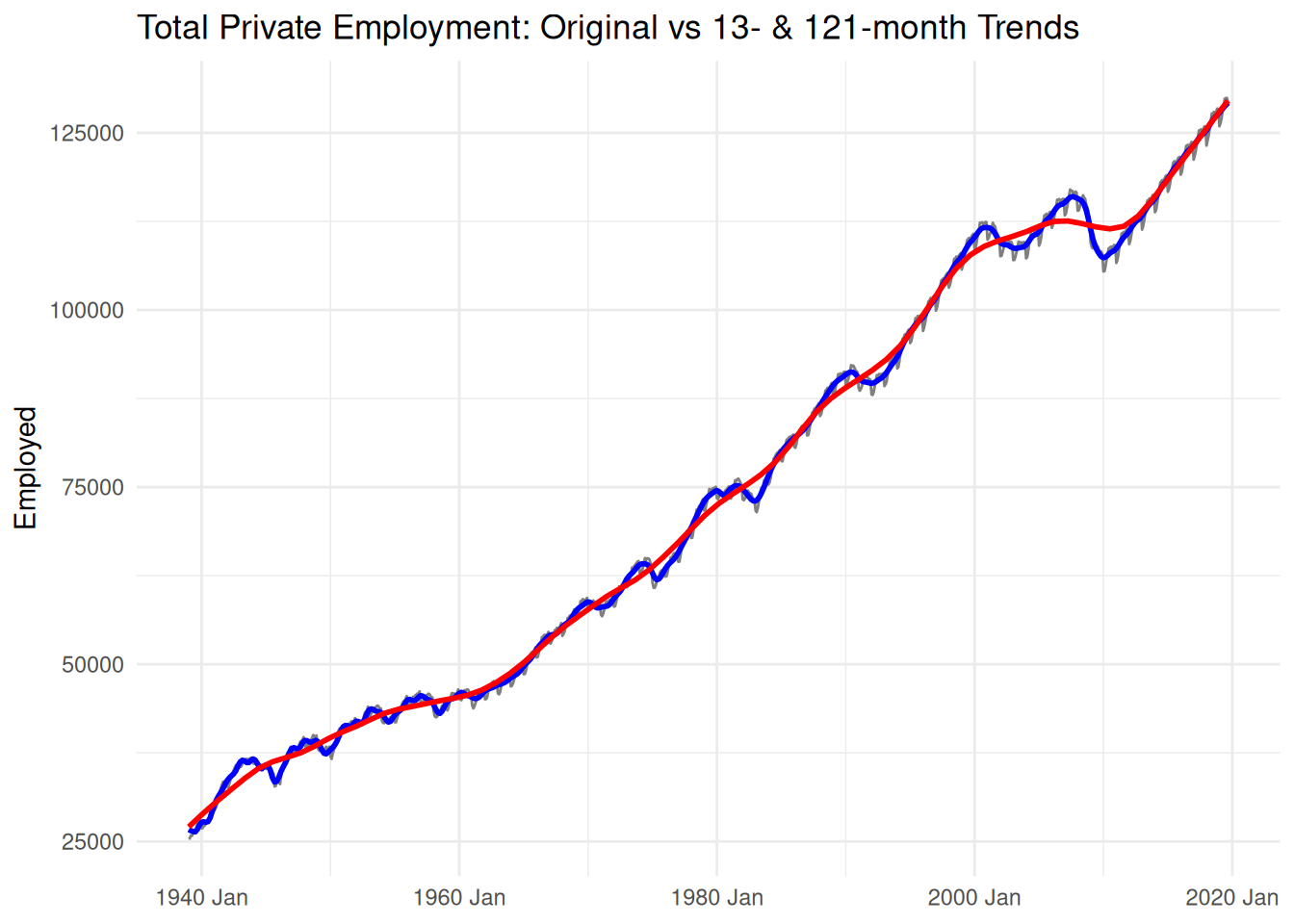

2. Overlay the original series with each smoothed trend to see how “cycle smoothing” differs.

3. Discuss in writing:

• How a 13-month vs 121-month window would affect decisions about recessions or stimulus timing.

• Which choice feels more “transparent,” and what you’d need to report to a policymaker.# 1. Side‐by‐side trend plots

trend_short <- decomp_short %>% select(Month, trend)

trend_long <- decomp_long %>% select(Month, trend)

p_short <- ggplot(trend_short, aes(Month, trend)) +

geom_line() +

labs(title="13-month STL Trend", y="Trend")

p_long <- ggplot(trend_long, aes(Month, trend)) +

geom_line() +

labs(title="121-month STL Trend", y="Trend")

library(gridExtra)

grid.arrange(p_short, p_long)

# 2. Overlay original series with both trends

empl_with_trends <- empl_ts %>%

left_join(trend_short, by="Month") %>%

rename(trend_short = trend) %>%

left_join(trend_long, by="Month") %>%

rename(trend_long = trend)

ggplot(empl_with_trends, aes(Month, Employed)) +

geom_line(color="gray50") +

geom_line(aes(y=trend_short), color="blue", size=1) +

geom_line(aes(y=trend_long), color="red", size=1) +

labs(

title="Total Private Employment: Original vs 13- & 121-month Trends",

y="Employed", x=NULL

) +

theme_minimal()

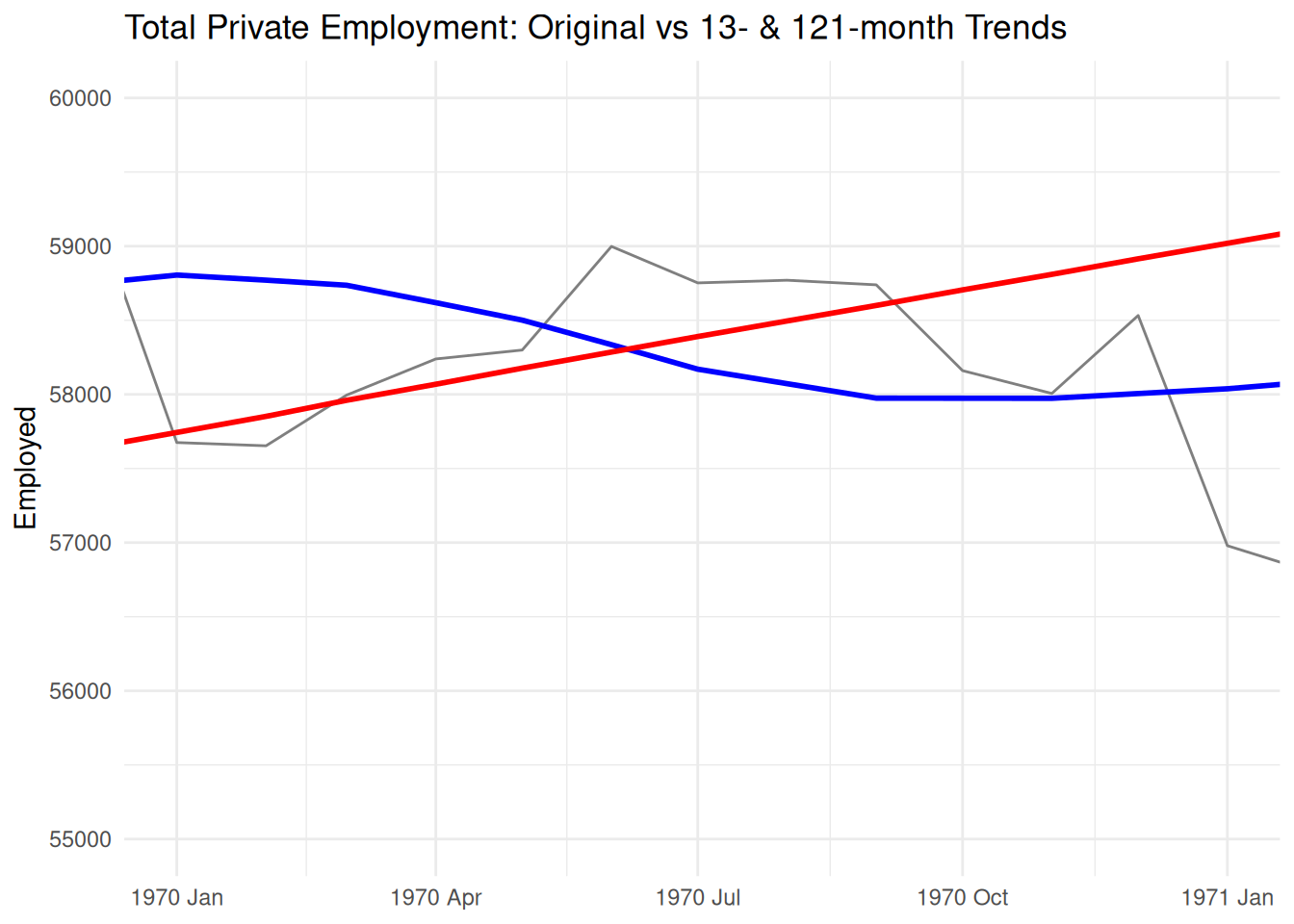

# Zoomed-in plot

ggplot(empl_with_trends, aes(Month, Employed)) +

geom_line(color="gray50") +

geom_line(aes(y=trend_short), color="blue", size=1) +

geom_line(aes(y=trend_long), color="red", size=1) +

labs(

title="Total Private Employment: Original vs 13- & 121-month Trends",

y="Employed", x=NULL

) +

coord_cartesian(xlim = yearmonth(c("1970 Jan", "1971 Jan"))) +

scale_y_continuous(limits = c(55000, 60000))+

theme_minimal()

Overlaid plot

# 1. Full‐series plot

p_main <- ggplot(empl_with_trends, aes(x = Month)) +

geom_line(aes(y = Employed, color = "Original")) +

geom_line(aes(y = trend_short, color = "13-month Trend")) +

geom_line(aes(y = trend_long, color = "121-month Trend")) +

scale_color_manual(

name = "Series",

values = c(

"Original" = "grey40",

"13-month Trend" = "purple",

"121-month Trend" = "lightblue"

)

) +

labs(

title = "Total Private Employment: Original vs 13- & 121-month Trends",

y = "Employed", x = NULL

) +

theme_minimal() +

theme(

axis.text.x = element_text(angle = 45, hjust = 1),

legend.position = "bottom",

legend.direction = "horizontal"

)

# 2. Zoomed‐in plot

p_inset <- ggplot(empl_with_trends, aes(x = Month)) +

geom_line(aes(y = Employed), color = "grey50") +

geom_line(aes(y = trend_short), color = "purple", size = 1) +

geom_line(aes(y = trend_long), color = "lightblue", size = 1) +

coord_cartesian(

xlim = yearmonth(c("2006 May", "2012 Jan")),

ylim = c(100000, 120000)

) +

labs(x = NULL, y = NULL) +

theme(

legend.position = "none",

axis.text.x = element_text(angle = 45, hjust = 1),

) +

ggthemes::theme_tufte()

# 3. Combine with cowplot

library(cowplot)

combined <- ggdraw() +

draw_plot(p_main) +

draw_plot(p_inset, x = 0.10, y = 0.45, width = 0.35, height = 0.35)

combined