library(COVID19)

library(fpp3)

# Get data

covid_data <- covid19(country = "Italy", level = 1, verbose = FALSE) %>%

as_tsibble(index = date) %>%

mutate(new_cases = difference(confirmed)) %>%

mutate(log_new_cases = difference(log(confirmed))) %>%

drop_na(log_new_cases, new_cases) %>%

mutate(scaled_cases = scale(log_new_cases))Activity24

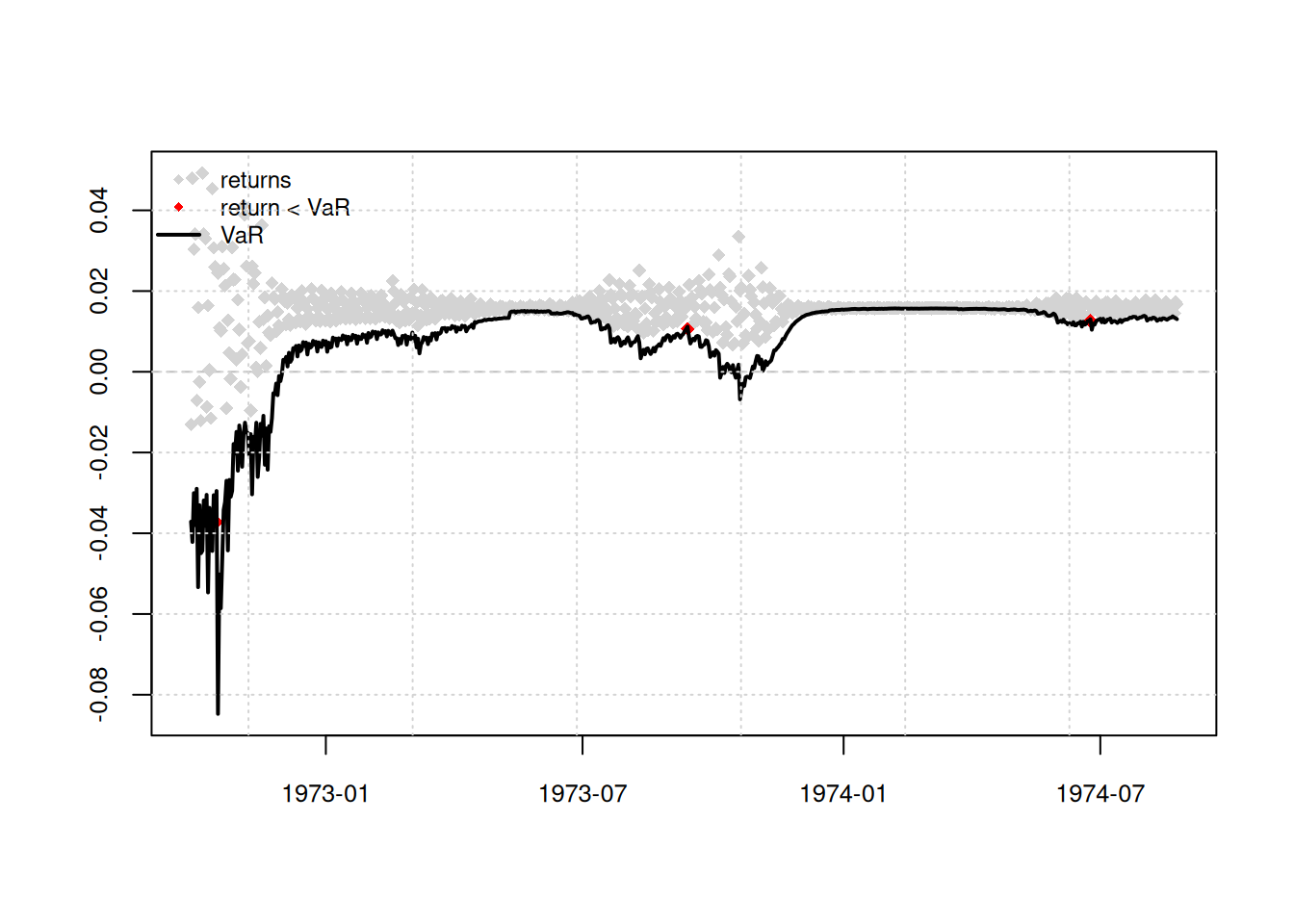

Theoretical Background: Volatility Clustering

Volatility clustering (periods of high/low variability persisting) violates ARIMA’s constant variance assumption. Common in COVID-19 cases (waves) and stock returns (crashes). ARCH (Autoregressive Conditional Heteroskedasticity) tests help detect this phenomenon.

Mathematical Foundation

ARCH Model:

The ARCH(q) model for volatility is defined as:

\[ \begin{align*} r_t &= \mu_t + \epsilon_t, \quad \epsilon_t = \sigma_t z_t, \\ \sigma_t^2 &= \alpha_0 + \alpha_1 \epsilon_{t-1}^2 + \dots + \alpha_q \epsilon_{t-q}^2 \end{align*} \]

where \(z_t \sim N(0,1)\), and \(\alpha_0 > 0\), \(\alpha_i \geq 0\).Key Idea:

Variance \(\sigma_t^2\) depends on past squared residuals (\(\epsilon_{t-1}^2, \dots, \epsilon_{t-q}^2\)), capturing volatility clustering.

Testing Steps

Fit ARIMA Model:

Model the mean structure (e.g., log returns).Extract Residuals:

Compute residuals \(\epsilon_t\) and squared residuals \(\epsilon_t^2\).Visual Diagnostics:

- Plot ACF/PACF of squared residuals.

- Look for significant autocorrelation (sign of ARCH effects).

- Plot ACF/PACF of squared residuals.

Statistical Tests:

- Ljung-Box Test: Tests autocorrelation in \(\epsilon_t^2\).

- Engle’s ARCH Test: Formal Lagrange Multiplier (LM) test for ARCH effects.

- Ljung-Box Test: Tests autocorrelation in \(\epsilon_t^2\).

Example 1: COVID-19 Cases

Data Preparation

Use the COVID19 package to fetch daily confirmed cases in Italy (clear volatility during waves):

Model Fitting & Volatility Check

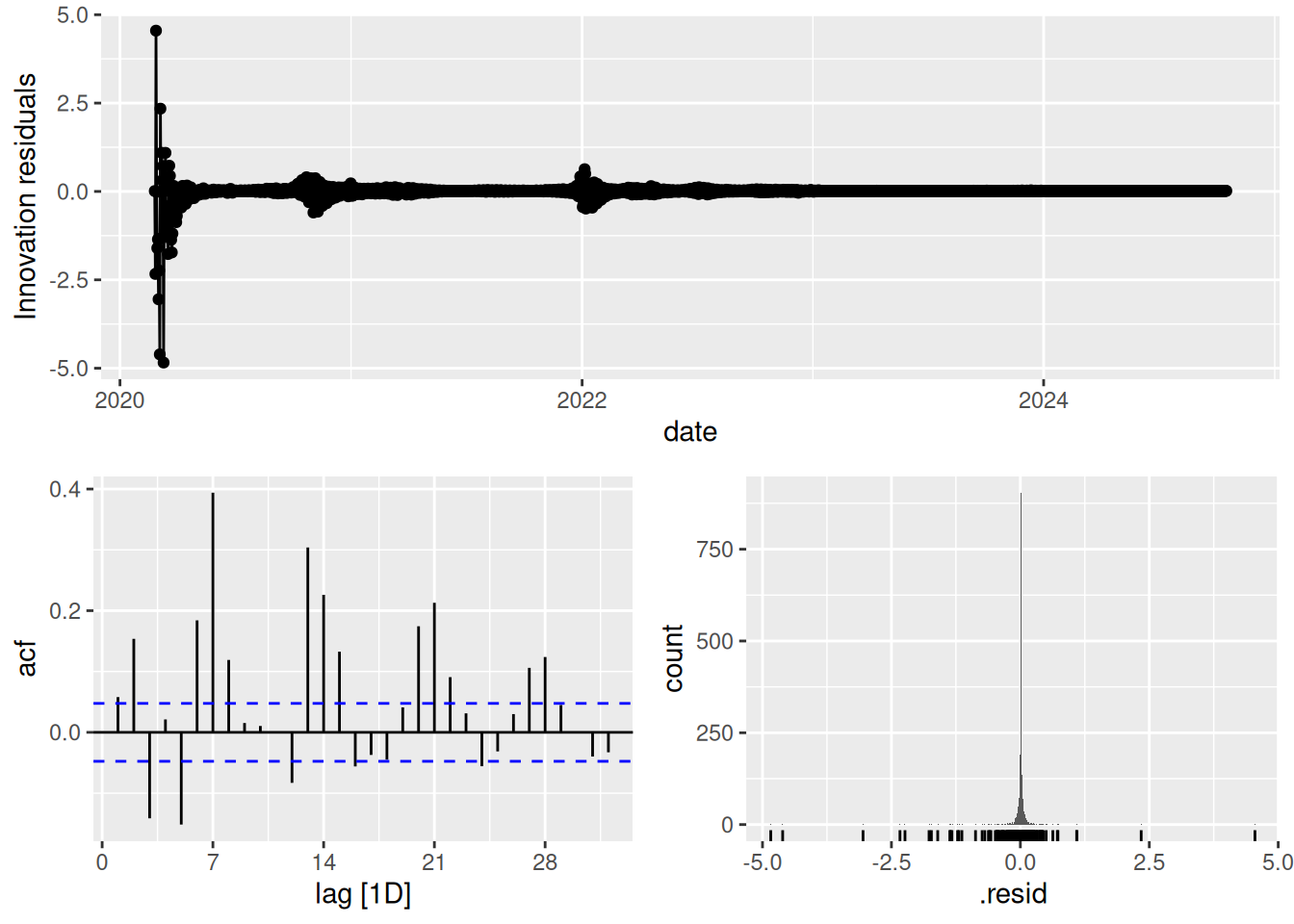

Fit an ARIMA model to new_cases and inspect residuals:

fit_covid <- covid_data %>%

model(ARIMA(scaled_cases ~ pdq(2,1,1) + PDQ(0,0,0)))

# Check residuals for volatility clustering

fit_covid %>% gg_tsresiduals()

fit_covid %>%

augment() %>%

features(.innov,~ljung_box(.x, lag=24, dof=4)

)# A tibble: 1 × 3

.model lb_stat lb_pvalue

<chr> <dbl> <dbl>

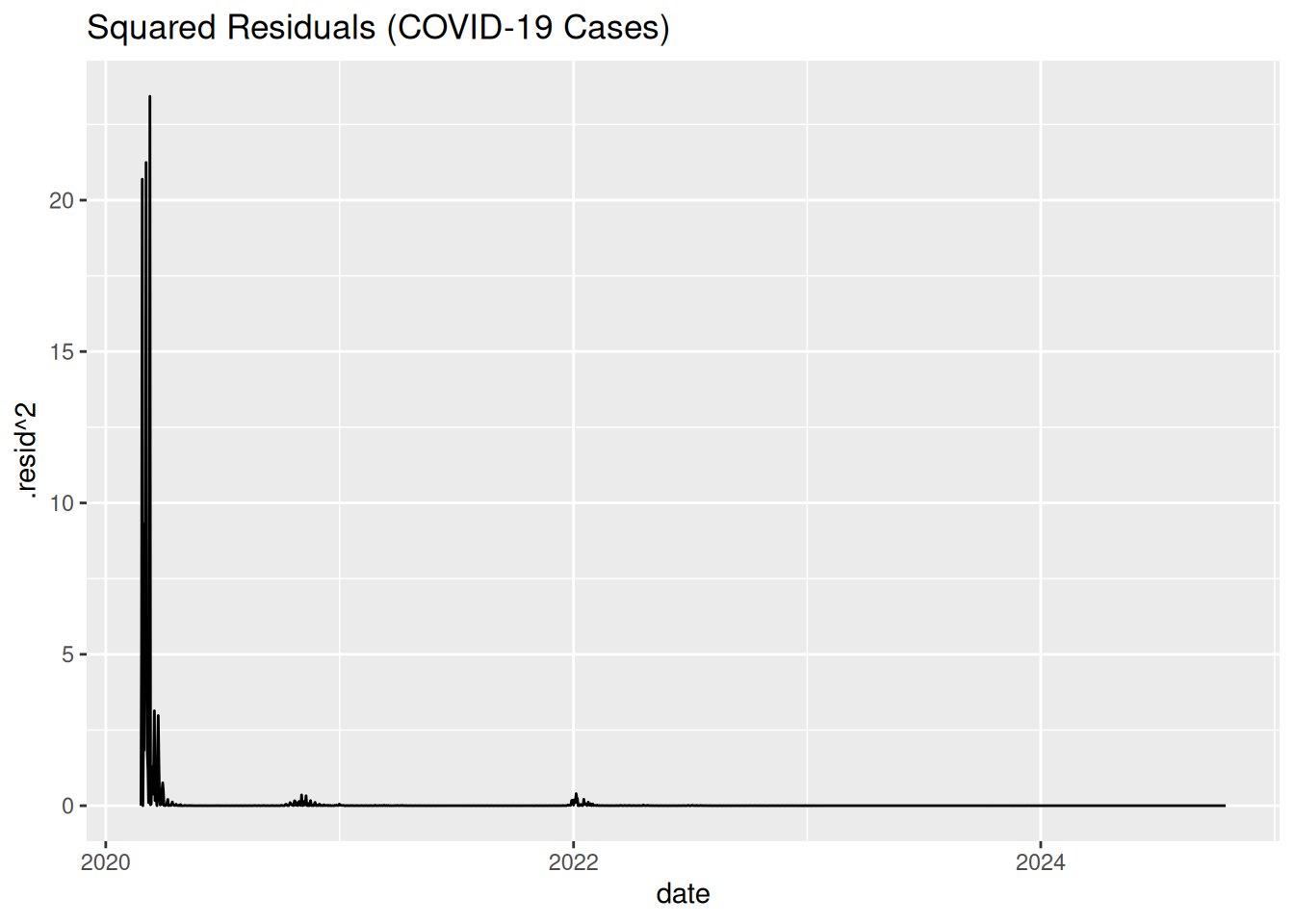

1 ARIMA(scaled_cases ~ pdq(2, 1, 1) + PDQ(0, 0, 0)) 920. 0augment(fit_covid) %>%

ggplot(aes(x = date, y = .resid^2)) +

geom_line() + labs(title = "Squared Residuals (COVID-19 Cases)")

Key Observation: Squared residuals cluster many times between January 2020 and January 2023 (COVID waves), indicating volatility clustering.

Example 2: Stock Returns

Data Preparation

Fetch S&P 500 returns using tq_get() (more realistic volatility with irregular trading days):

# Get S&P 500 data and calculate daily returns

sp500 <- tq_get("^GSPC", get = "stock.prices", from = "2000-01-01") %>%

as_tsibble(index = date) %>%

fill_gaps() %>%

fill(close, .direction = "down") %>%

mutate(return = difference(log(close))) %>%

drop_na(return) Model Fitting & Volatility Check

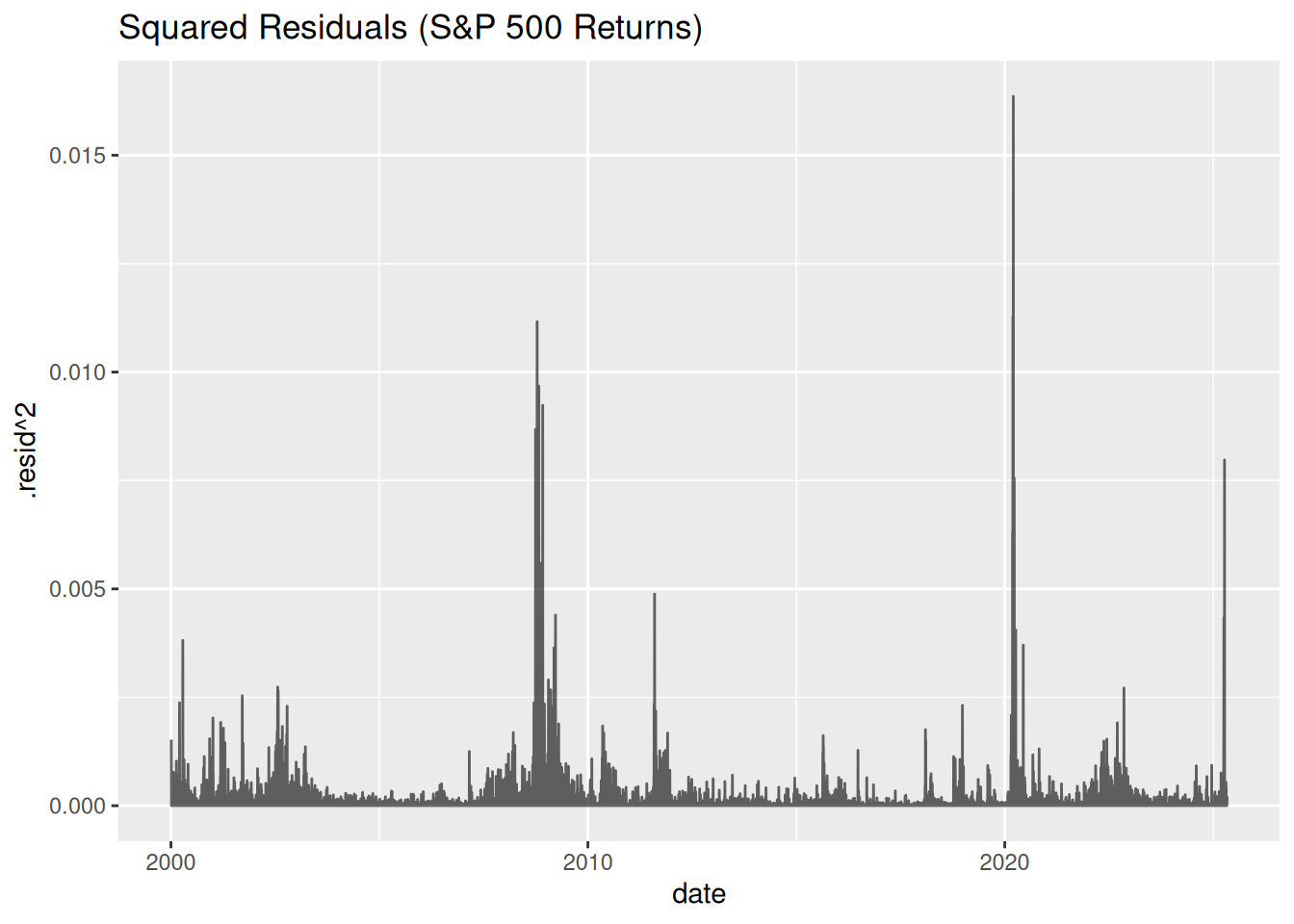

fit_sp500 <- sp500 %>%

model(ARIMA(return ~ pdq(1,0,1)))

# Visualize squared residuals for volatility clustering

augment(fit_sp500) %>%

ggplot(aes(x = date, y = .resid^2)) +

geom_line(alpha = 0.6) +

labs(title = "Squared Residuals (S&P 500 Returns)")

Key Observations:

- Squared residuals cluster during crises (e.g., 2008 financial crisis, 2020 COVID crash).

- ARIMA assumes constant variance — clustered residuals violate this, signaling volatility clustering.

Fix: COVID-19 Cases

1. Extract Residuals

First, extract residuals from the ARIMA model:

# For COVID-19 example:

covid_resid <- augment(fit_covid) %>%

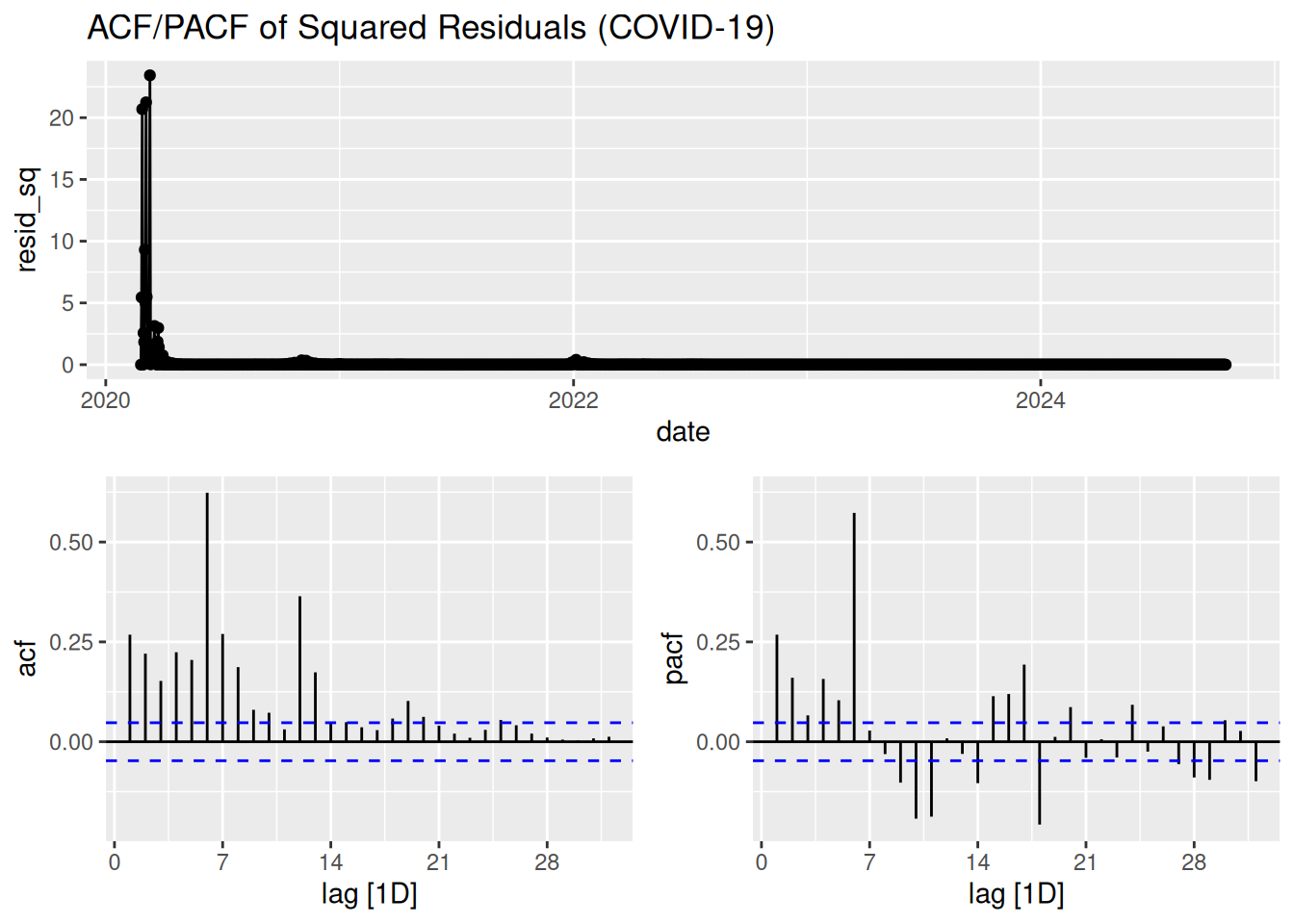

select(date, .resid)2. Visual ARCH Test (ACF/PACF of Squared Residuals)

Plot autocorrelation in squared residuals:

covid_resid %>%

mutate(resid_sq = .resid^2) %>%

gg_tsdisplay(resid_sq, plot_type = "partial") +

labs(title = "ACF/PACF of Squared Residuals (COVID-19)")

Interpretation:

- Significant spikes at lag 1 or higher → Evidence of ARCH effects.

3. Engle’s ARCH Test

Use the FinTS package to test ARCH effects on residuals:

library(FinTS) # install.packages("FinTS")

# Extract residual vector

resid_vector <- covid_resid %>% pull(.resid)

# Engle’s ARCH test (lag = 5)

ArchTest(resid_vector, lags = 5, demean = TRUE)

ARCH LM-test; Null hypothesis: no ARCH effects

data: resid_vector

Chi-squared = 273.72, df = 5, p-value < 2.2e-16Conclusion: If \(p < 0.05\), reject the null (ARCH effects exist).

Next Steps: GARCH Modeling

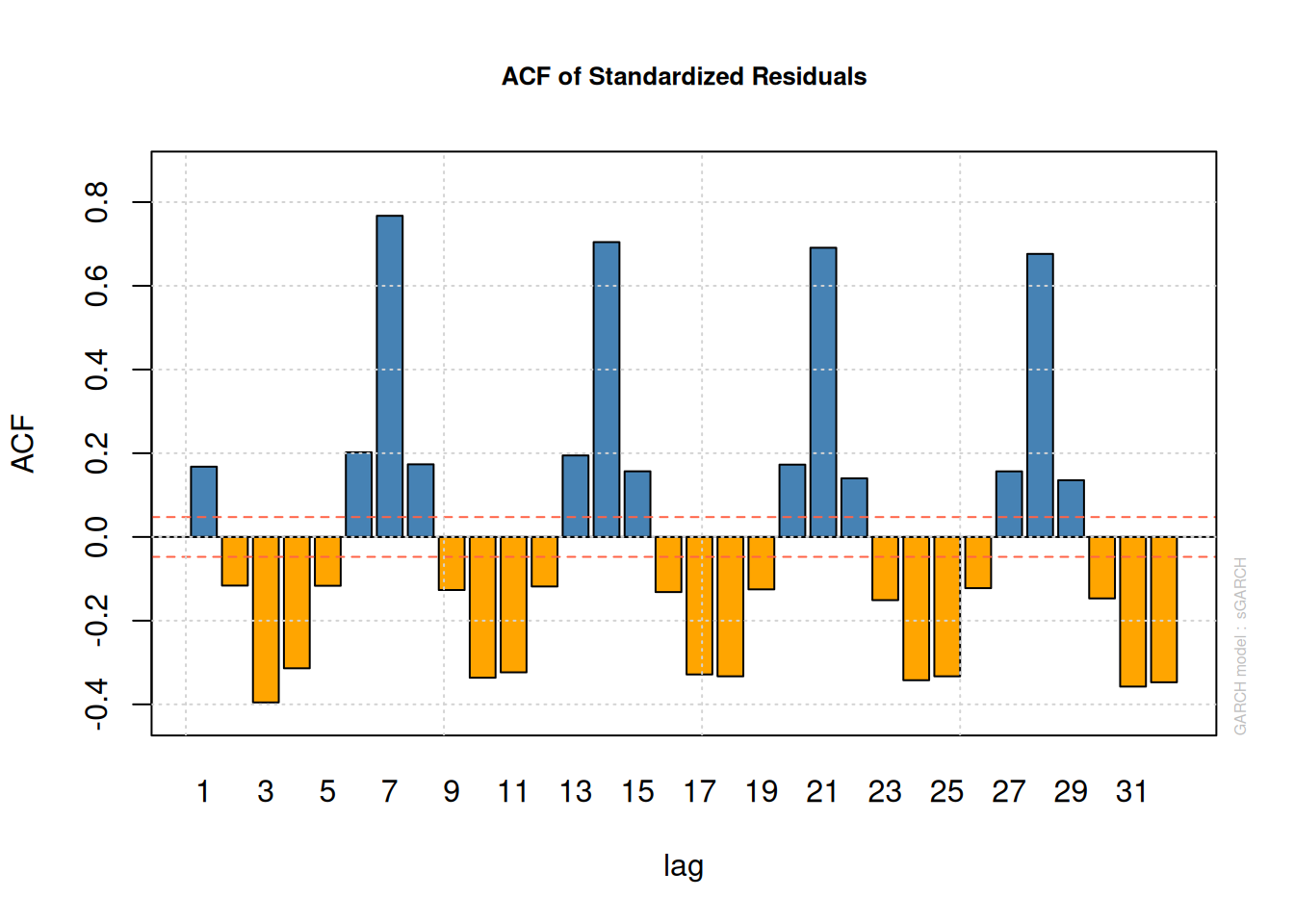

If ARCH effects are detected, use the rugarch package to model volatility:

library(rugarch) # install.packages("rugarch")

# Fit ARIMA(1,0,1)-GARCH(1,1)

spec <- ugarchspec(

mean.model = list(armaOrder = c(1,1)),

variance.model = list(model = "sGARCH")

)

fit_garch <- ugarchfit(spec, data = resid_vector)

plot(fit_garch, which = 10)

Parameter Stability

Check rolling estimates to assess model stability over time:

roll_fit <- ugarchroll(spec, data = resid_vector, n.ahead = 1, n.start = 1000)

plot(roll_fit, which = 4) # Rolling parameter estimates

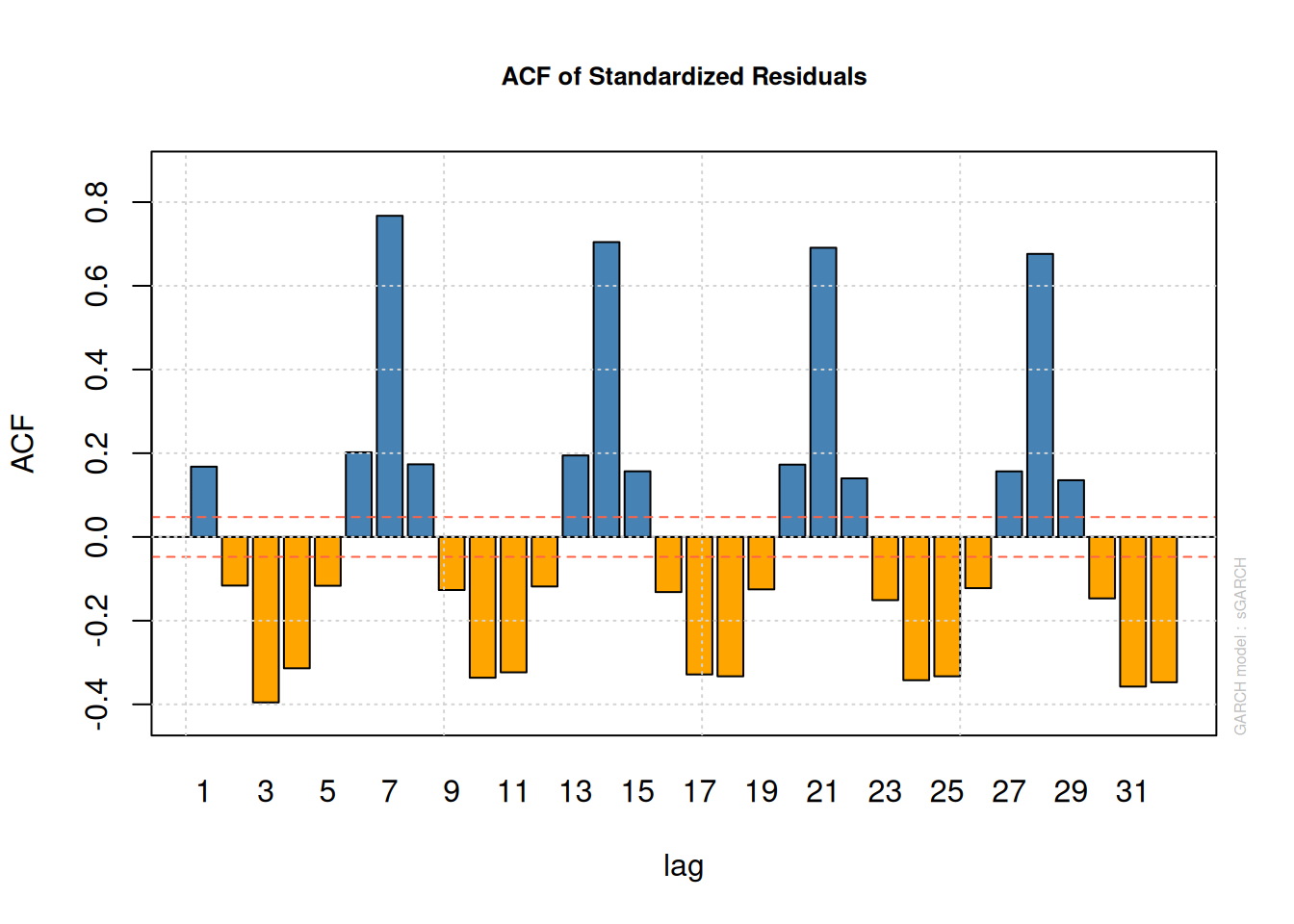

Lab activity: S&P 500 Returns

Repeat the above steps for S&P Returns

# Extract residuals from ARIMA

sp500_resid <- augment(fit_sp500) %>% select(date, .resid)

# Engle’s test

resid_sp500 <- sp500_resid %>% pull(.resid)

ArchTest(resid_sp500, lags = 5, demean = TRUE)

ARCH LM-test; Null hypothesis: no ARCH effects

data: resid_sp500

Chi-squared = 984.26, df = 5, p-value < 2.2e-16# ACF/PACF of squared residuals

sp500_resid %>%

mutate(resid_sq = .resid^2) %>%

gg_tsdisplay(resid_sq, plot_type = "partial")