# Retrieve COVID-19 data for the United States and prepare a tsibble

# Get cumulative COVID metrics

covid_raw <- covid19(country = "US", level = 1, verbose = FALSE) %>%

as_tsibble(index = date) %>%

select(date, confirmed, people_vaccinated) %>%

rename(vaccines = people_vaccinated)Activity42

ARCH Effects in Case Volatility

Data Preparation

We first convert raw cumulative COVID-19 data to new weekly cases/vaccinations using lagged differences. Log-transformation stabilizes variance while preserving relative changes. Weekly aggregation reduces daily reporting noise (e.g., weekend under-reporting).

# Convert to NEW weekly cases

covid_weekly <- covid_raw %>%

mutate(across(c(confirmed, vaccines), ~. - lag(.))) %>% # Calculate daily changes

index_by(week = yearweek(date)) %>%

summarize(

cases = sum(confirmed, na.rm = TRUE),

vaccines = sum(vaccines, na.rm = TRUE)

) %>%

filter(cases > 0, vaccines >= 0) %>%

mutate(across(c(cases, vaccines), ~ log(. + 1))) 1. Residual Diagnostics

Activity 1: Residuals Volatility Analysis

library(strucchange)

bp_multi <- breakpoints(cases ~ 1 + vaccines, data = covid_weekly, h = 0.05, breaks = 3)

break_dates <- covid_weekly$week[bp_multi$breakpoints]

# Create intervention dummy

library(fastDummies)

covid_weekly <- covid_weekly %>%

mutate(

intervention_period = case_when(

week < break_dates[1] ~ "pre",

week >= break_dates[1] & week < break_dates[2] ~ "phase1",

week >= break_dates[2] & week < break_dates[3] ~ "phase2",

week >= break_dates[3] ~ "post"

)

) %>%

dummy_cols(select_columns = "intervention_period") %>%

as_tsibble(index = week)

arima_model <- covid_weekly %>%

model(fable::ARIMA(cases ~ vaccines + intervention_period))

report(arima_model)Series: cases

Model: LM w/ ARIMA(3,0,2)(1,0,0)[52] errors

Coefficients:

ar1 ar2 ar3 ma1 ma2 sar1 vaccines

2.2057 -1.6628 0.4427 -0.9343 0.7572 0.0876 0.0007

s.e. 0.1185 0.2460 0.1407 0.0887 0.0845 0.1161 0.0152

intervention_periodphase2 intervention_periodpost

0.062 0.2065

s.e. 0.235 0.3108

intervention_periodpre intercept

-0.2380 11.5382

s.e. 0.2447 1.4644

sigma^2 estimated as 0.08206: log likelihood=-25.9

AIC=75.79 AICc=77.83 BIC=113.14arima_model %>%

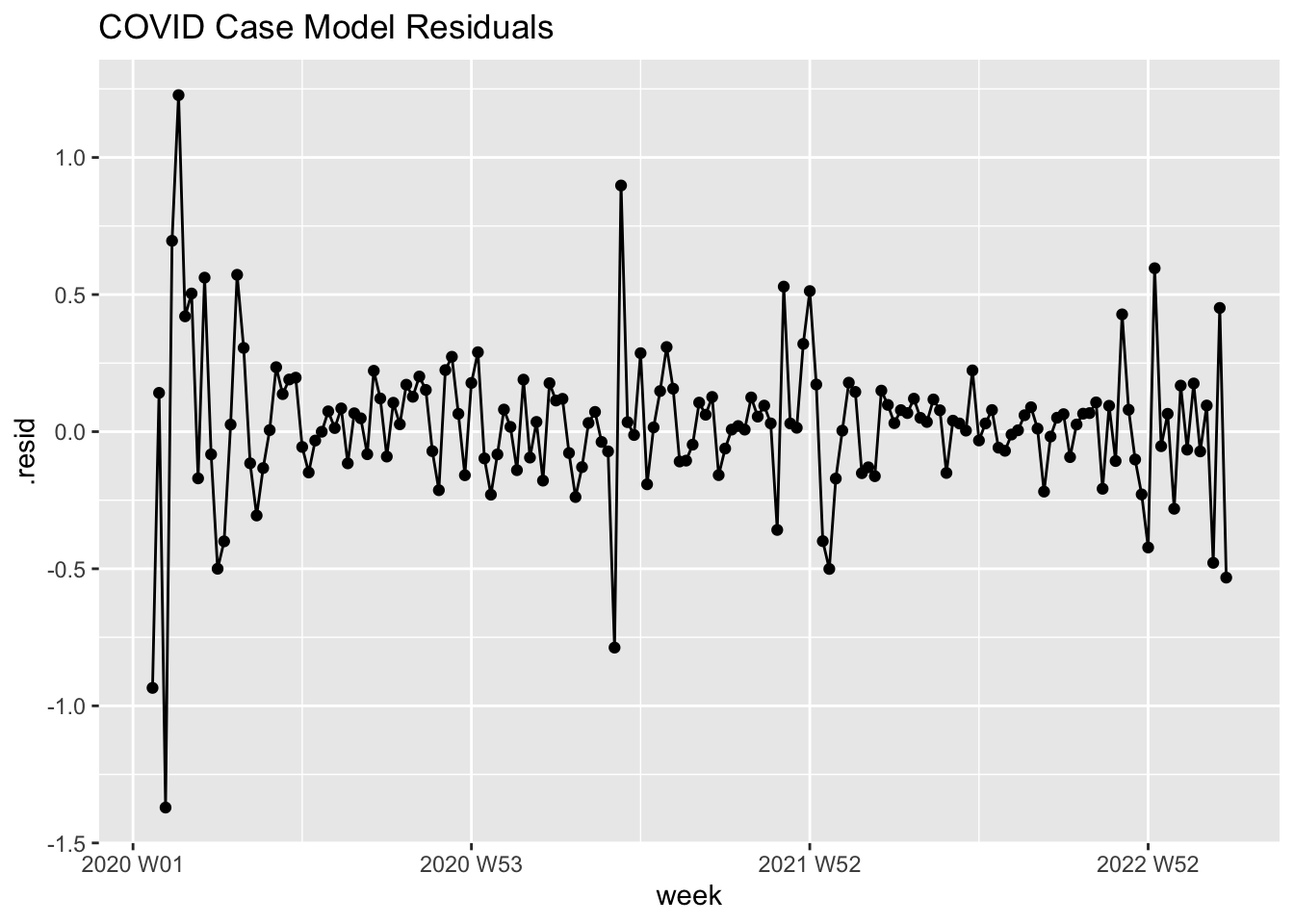

residuals() %>%

ggplot(aes(x = week, y = .resid)) +

geom_line() + geom_point() +

labs(title = "COVID Case Model Residuals")

Graphical Analysis

First, let’s examine residuals from our intervention ARIMA model visually:

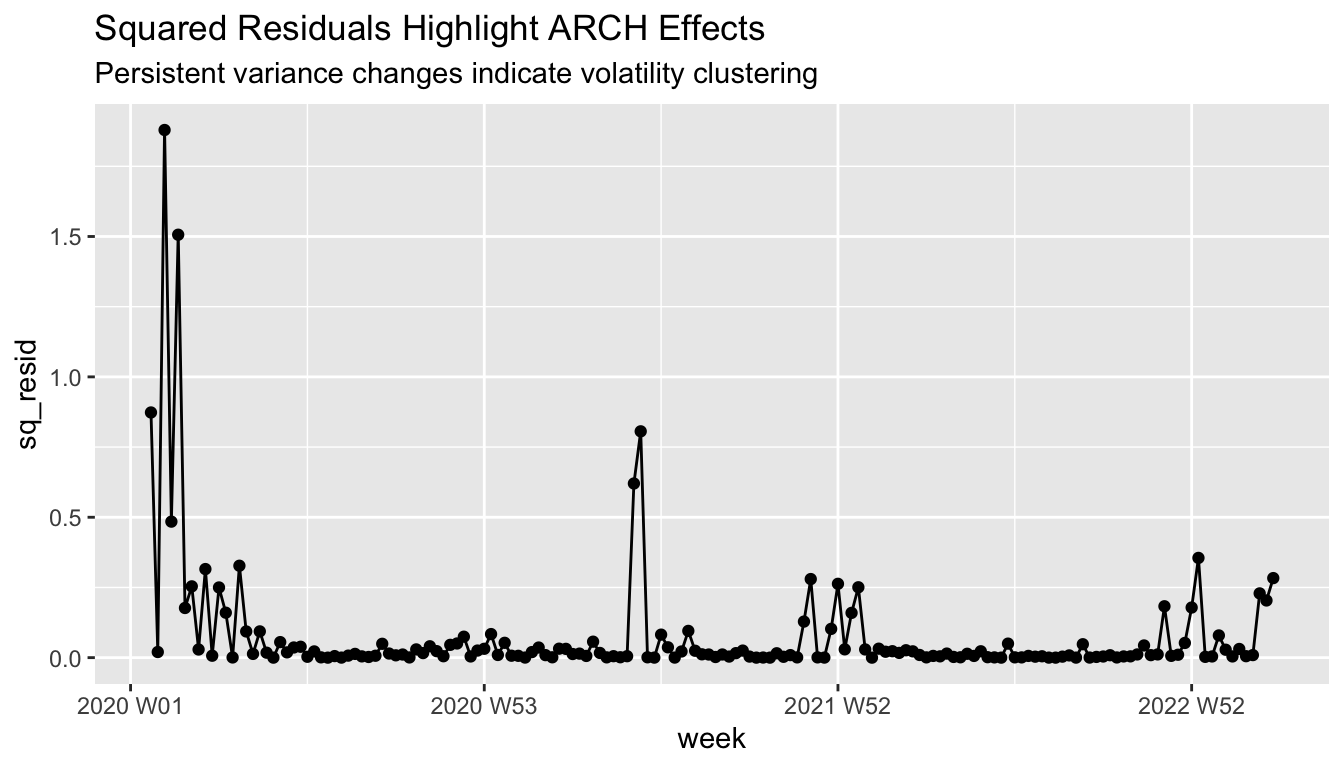

squared_residual_plot <- arima_model %>%

residuals() %>%

mutate(sq_resid = .resid^2) %>%

ggplot(aes(x = week, y = sq_resid)) +

geom_line() + geom_point() +

labs(title = "Squared Residuals Highlight ARCH Effects",

subtitle = "Persistent variance changes indicate volatility clustering")

squared_residual_plot

- Residuals show clear volatility clustering (periods of high/low dispersion)

- Squared residuals demonstrate time-varying variance - violates constant variance assumption

Activity 2: ARCH LM Test

library(FinTS)

residuals <- resid(arima_model) %>% pull(.resid)

ArchTest(residuals, lags = 4)

ARCH LM-test; Null hypothesis: no ARCH effects

data: residuals

Chi-squared = 64.113, df = 4, p-value = 3.957e-13The significant p-value (<<0.05) rejects the null hypothesis of no ARCH effects, confirming volatility clustering needs modeling.

3. GARCH Modeling

Model Specification

We use GARCH(1,1) to model both:

- ARCH term (\(\alpha\)): Immediate shock impact

- GARCH term (\(\beta\)): Persistent volatility memory

# GARCH(1,1) Estimation

library(rugarch)

# Use ARIMA residuals as input series

garch_spec <- ugarchspec(

variance.model = list(model = "sGARCH", garchOrder = c(1,1)),

mean.model = list(armaOrder = c(3,0), include.mean = FALSE)

)

garch_fit <- ugarchfit(

spec = garch_spec,

data = residuals[!is.na(residuals)] # Remove NA from differencing

)

garch_fit

*---------------------------------*

* GARCH Model Fit *

*---------------------------------*

Conditional Variance Dynamics

-----------------------------------

GARCH Model : sGARCH(1,1)

Mean Model : ARFIMA(3,0,0)

Distribution : norm

Optimal Parameters

------------------------------------

Estimate Std. Error t value Pr(>|t|)

ar1 0.042417 0.111648 0.37992 0.704009

ar2 -0.053242 0.101358 -0.52529 0.599385

ar3 -0.363783 0.110194 -3.30130 0.000962

omega 0.010593 0.002734 3.87514 0.000107

alpha1 0.342966 0.115412 2.97168 0.002962

beta1 0.422297 0.102669 4.11318 0.000039

Robust Standard Errors:

Estimate Std. Error t value Pr(>|t|)

ar1 0.042417 0.183638 0.23098 0.817331

ar2 -0.053242 0.134968 -0.39448 0.693229

ar3 -0.363783 0.190919 -1.90543 0.056724

omega 0.010593 0.004455 2.37767 0.017422

alpha1 0.342966 0.084932 4.03813 0.000054

beta1 0.422297 0.082181 5.13860 0.000000

LogLikelihood : 18.8111

Information Criteria

------------------------------------

Akaike -0.154351

Bayes -0.041869

Shibata -0.156844

Hannan-Quinn -0.108694

Weighted Ljung-Box Test on Standardized Residuals

------------------------------------

statistic p-value

Lag[1] 3.200 0.073660

Lag[2*(p+q)+(p+q)-1][8] 6.256 0.004592

Lag[4*(p+q)+(p+q)-1][14] 7.285 0.504281

d.o.f=3

H0 : No serial correlation

Weighted Ljung-Box Test on Standardized Squared Residuals

------------------------------------

statistic p-value

Lag[1] 0.124 0.7247

Lag[2*(p+q)+(p+q)-1][5] 4.214 0.2285

Lag[4*(p+q)+(p+q)-1][9] 5.268 0.3911

d.o.f=2

Weighted ARCH LM Tests

------------------------------------

Statistic Shape Scale P-Value

ARCH Lag[3] 0.1476 0.500 2.000 0.7008

ARCH Lag[5] 1.5388 1.440 1.667 0.5822

ARCH Lag[7] 1.8114 2.315 1.543 0.7572

Nyblom stability test

------------------------------------

Joint Statistic: 1.448

Individual Statistics:

ar1 0.74404

ar2 0.12425

ar3 0.16236

omega 0.06102

alpha1 0.05590

beta1 0.04914

Asymptotic Critical Values (10% 5% 1%)

Joint Statistic: 1.49 1.68 2.12

Individual Statistic: 0.35 0.47 0.75

Sign Bias Test

------------------------------------

t-value prob sig

Sign Bias 0.4036 0.6870

Negative Sign Bias 0.1300 0.8967

Positive Sign Bias 0.2986 0.7657

Joint Effect 0.6799 0.8779

Adjusted Pearson Goodness-of-Fit Test:

------------------------------------

group statistic p-value(g-1)

1 20 25.81 0.13565

2 30 48.34 0.01356

3 40 56.65 0.03355

4 50 70.75 0.02266

Elapsed time : 0.03699303 Model Equation

\[ \sigma_t^2 = 0.0106 + 0.343\epsilon_{t-1}^2 + 0.422\sigma_{t-1}^2 \]

Key Updates: 1. Persistence: \(\alpha + \beta = 0.343 + 0.422 = 0.765\)

2. Half-life: \(\log(0.5)/\log(0.765) \approx 2.58\) weeks

Model Diagnostics

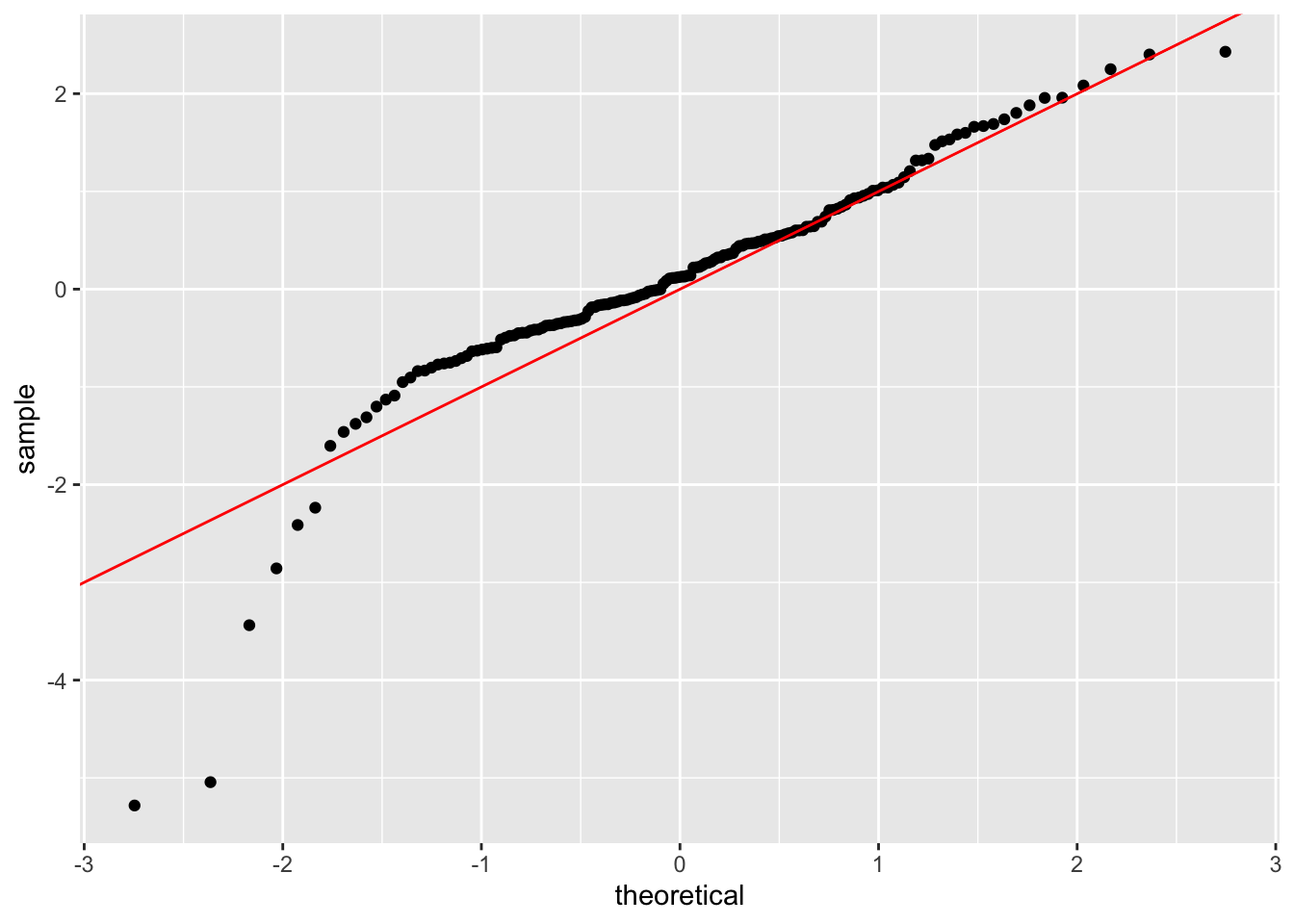

library(ggfortify)

std_resid <- residuals(garch_fit, standardize=TRUE)

dat <- fortify.zoo(std_resid)

# Now create the Q-Q plot using the converted data

ggplot(dat, aes(sample = std_resid)) +

stat_qq() +

geom_abline(slope = 1, intercept = 0, color = "red")

Diagnostic Checks:

- No significant autocorrelation in squared residuals → GARCH captures volatility clustering

- QQ-plot shows heavier tails than normal distribution → Consider Student-t innovations

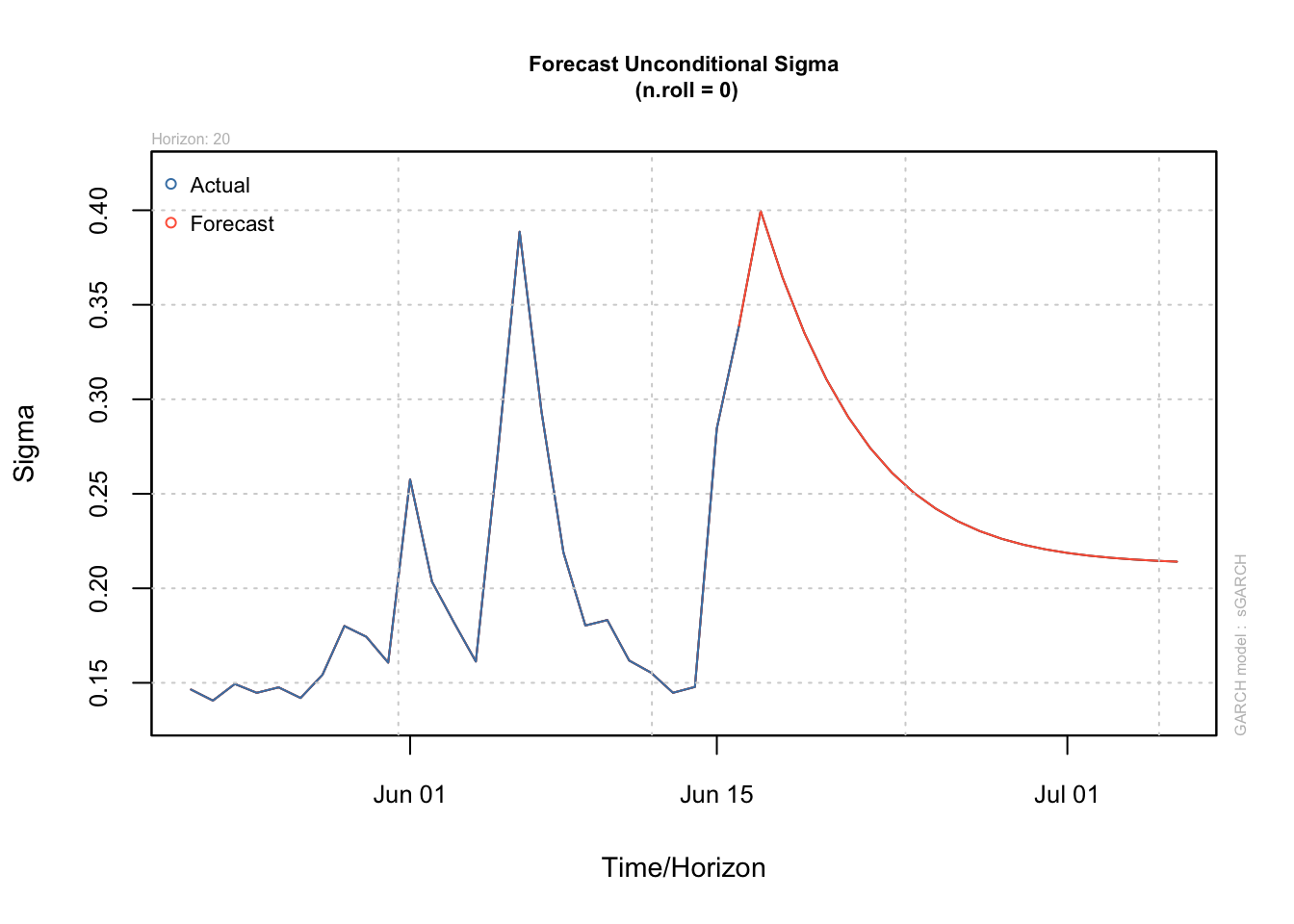

4. Forecasting with GARCH

Conditional Variance Forecast

garch_forecast <- ugarchforecast(garch_fit, n.ahead = 20)

plot(garch_forecast, which = 3)

Forecast Interpretation: - Volatility slowly mean-reverts due to high persistence - Prediction intervals widen initially then stabilize

5. Asymmetric Volatility with EGARCH

Model Implementation

egarch_spec <- ugarchspec(

variance.model = list(model = "eGARCH"),

mean.model = list(armaOrder = c(3,0), include.mean = FALSE)

)

egarch_fit <- ugarchfit(egarch_spec, data = residuals[!is.na(residuals)])

egarch_fit

*---------------------------------*

* GARCH Model Fit *

*---------------------------------*

Conditional Variance Dynamics

-----------------------------------

GARCH Model : eGARCH(1,1)

Mean Model : ARFIMA(3,0,0)

Distribution : norm

Optimal Parameters

------------------------------------

Estimate Std. Error t value Pr(>|t|)

ar1 0.18186 0.103358 1.7596 0.078483

ar2 -0.13284 0.086495 -1.5358 0.124576

ar3 -0.34822 0.096555 -3.6065 0.000310

omega -0.49365 0.158187 -3.1206 0.001805

alpha1 -0.32572 0.084450 -3.8570 0.000115

beta1 0.83480 0.046362 18.0061 0.000000

gamma1 0.46821 0.110173 4.2497 0.000021

Robust Standard Errors:

Estimate Std. Error t value Pr(>|t|)

ar1 0.18186 0.152147 1.1953 0.231965

ar2 -0.13284 0.095333 -1.3935 0.163482

ar3 -0.34822 0.131049 -2.6572 0.007879

omega -0.49365 0.205857 -2.3980 0.016485

alpha1 -0.32572 0.114213 -2.8519 0.004346

beta1 0.83480 0.056665 14.7323 0.000000

gamma1 0.46821 0.136197 3.4377 0.000587

LogLikelihood : 23.93619

Information Criteria

------------------------------------

Akaike -0.204050

Bayes -0.072822

Shibata -0.207419

Hannan-Quinn -0.150784

Weighted Ljung-Box Test on Standardized Residuals

------------------------------------

statistic p-value

Lag[1] 2.620 0.10550

Lag[2*(p+q)+(p+q)-1][8] 5.691 0.03285

Lag[4*(p+q)+(p+q)-1][14] 6.655 0.62830

d.o.f=3

H0 : No serial correlation

Weighted Ljung-Box Test on Standardized Squared Residuals

------------------------------------

statistic p-value

Lag[1] 0.03506 0.8515

Lag[2*(p+q)+(p+q)-1][5] 4.43440 0.2046

Lag[4*(p+q)+(p+q)-1][9] 5.96715 0.3020

d.o.f=2

Weighted ARCH LM Tests

------------------------------------

Statistic Shape Scale P-Value

ARCH Lag[3] 0.4855 0.500 2.000 0.4860

ARCH Lag[5] 1.1793 1.440 1.667 0.6806

ARCH Lag[7] 1.9199 2.315 1.543 0.7343

Nyblom stability test

------------------------------------

Joint Statistic: 1.5439

Individual Statistics:

ar1 0.84216

ar2 0.10204

ar3 0.06074

omega 0.03966

alpha1 0.06067

beta1 0.04564

gamma1 0.05945

Asymptotic Critical Values (10% 5% 1%)

Joint Statistic: 1.69 1.9 2.35

Individual Statistic: 0.35 0.47 0.75

Sign Bias Test

------------------------------------

t-value prob sig

Sign Bias 0.09363 0.9255

Negative Sign Bias 0.50412 0.6149

Positive Sign Bias 0.15848 0.8743

Joint Effect 0.28269 0.9633

Adjusted Pearson Goodness-of-Fit Test:

------------------------------------

group statistic p-value(g-1)

1 20 24.12 0.1916

2 30 29.90 0.4188

3 40 34.00 0.6970

4 50 50.87 0.3999

Elapsed time : 0.03595304 EGARCH Equation

\[ \begin{aligned} \ln(\sigma_t^2) &= -0.493 + 0.835\ln(\sigma_{t-1}^2) + \\ &\quad 0.468\left(\frac{|\epsilon_{t-1}|}{\sigma_{t-1}} - \sqrt{2/\pi}\right) - 0.326\frac{\epsilon_{t-1}}{\sigma_{t-1}} \end{aligned} \]

Key Parameters: - \(\gamma = 0.468\) (positive asymmetric effect) - Negative \(\alpha = -0.326\) confirms leverage effect (negative shocks increase volatility more than positive ones)

Q1: Why does the ARCH(1) coefficient (\(\alpha=0.343\)) in pre-vaccine residuals suggest public health volatility?

Q2: The GARCH(1,1) persistence (\(\alpha+\beta=0.765\)) remains high post-vaccine. What does this mean for forecasting?

Q3: Why does the log transformation of cases (+1) make sense for volatility modeling, and what would happen if we used raw case counts?

Q4: The QQ-plot shows heavier tails than normal distribution. How does this impact our interpretation of “extreme case surge” probabilities?

Q5: The volatility half-life is ~2.58 weeks. What real-world public health processes might explain this persistence?