getSymbols ("CPIAUCSL" , src = "FRED" , auto.assign = TRUE )<- tibble (date = index (CPIAUCSL), CPI = as.numeric (CPIAUCSL[,1 ])) %>% arrange (date) %>% mutate (inflation = 100 * (CPI / lag (CPI) - 1 )) %>% mutate (Quarter = yearquarter (date)) %>% as_tsibble (index = date) %>% index_by (Quarter) %>% summarize (CPI = mean (CPI),inflation = mean (inflation))# Get US unemployment (monthly) getSymbols ("UNRATE" , src = "FRED" , auto.assign = TRUE )<- data.frame (date = index (UNRATE), Unemployment = as.numeric (UNRATE$ UNRATE)) %>% as_tsibble (index = date) %>% mutate (Quarter = yearquarter (date)) %>% index_by (Quarter) %>% summarize (Unemployment = mean (Unemployment))# Get US GDP (quarterly) and merge getSymbols ("GDP" , src = "FRED" , auto.assign = TRUE )<- data.frame (date = index (GDP), GDP = as.numeric (GDP$ GDP)) %>% as_tsibble (index = date) %>% mutate (Quarter = yearquarter (date))<- us_gdp %>% inner_join (us_unemp, by = "Quarter" ) %>% inner_join (cpi_data, by = "Quarter" ) %>% mutate (GDP_growth = 100 * (GDP / lag (GDP) - 1 )) %>% :: select (Quarter, date, GDP, GDP_growth, Unemployment, CPI, inflation) %>% drop_na ()# View the combined data head (combined_data) %>% knitr:: kable ()

1948 Q2

1948-04-01

272.567

2.5682805

3.666667

23.99333

0.9141472

1948 Q3

1948-07-01

279.196

2.4320626

3.766667

24.39667

0.2905382

1948 Q4

1948-10-01

280.366

0.4190604

3.833333

24.17333

-0.4258609

1949 Q1

1949-01-01

275.034

-1.9017998

4.666667

23.94333

-0.1942711

1949 Q2

1949-04-01

271.351

-1.3391072

5.866667

23.91667

0.0139470

1949 Q3

1949-07-01

272.889

0.5667936

6.700000

23.71667

-0.2362540

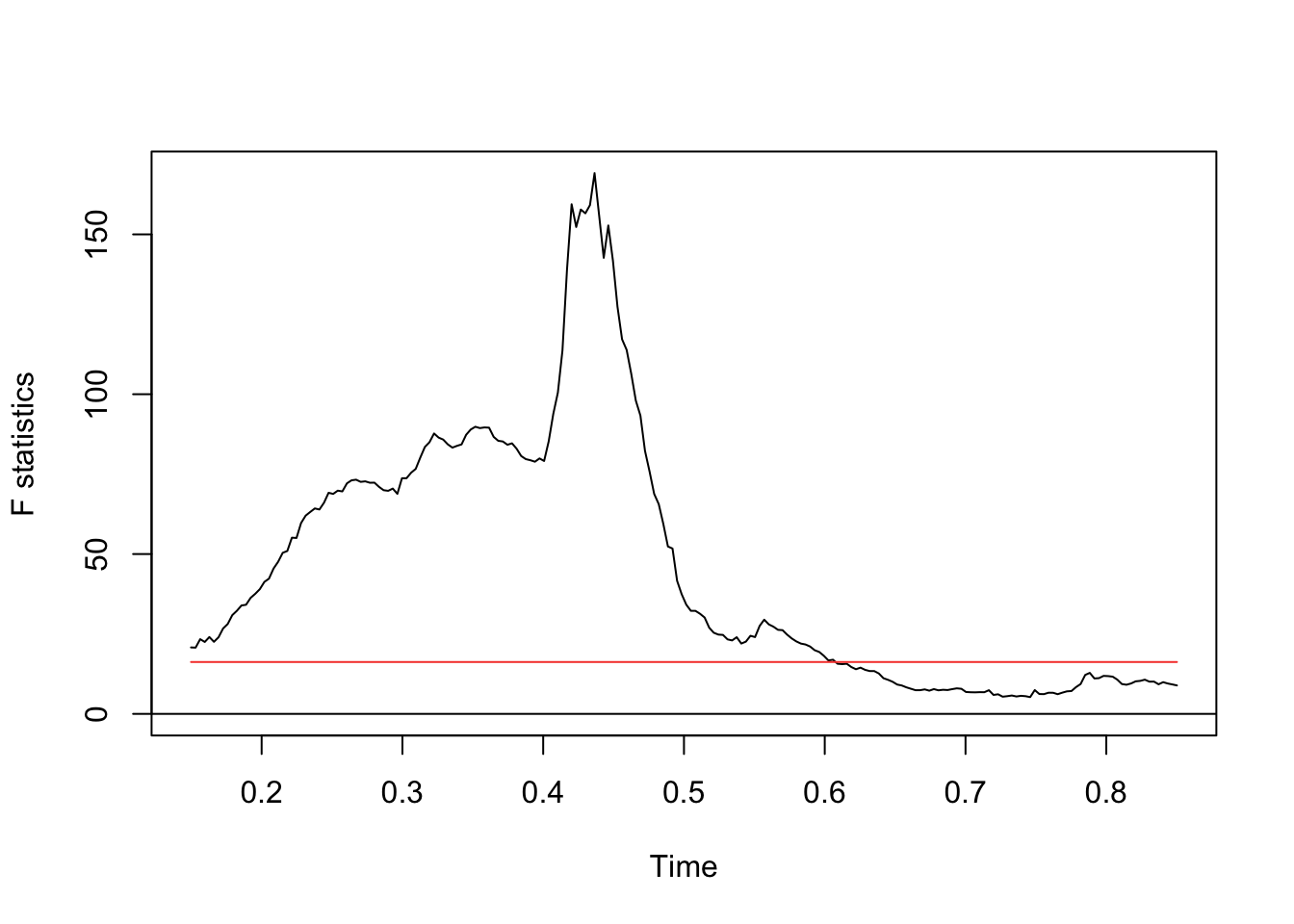

# Chow test for structural breaks <- Fstats (inflation ~ GDP_growth + Unemployment + CPI, data = combined_data)plot (break_test) # Identify potential breakpoints # Estimate breakpoint date(s) <- breakpoints (inflation ~ GDP_growth + Unemployment + CPI, data = combined_data)$ Quarter[bp$ breakpoints]

<yearquarter[1]>

[1] "1981 Q3"

# Year starts on: January

# Fit segmented regression <- lm (inflation ~ GDP_growth + Unemployment + CPI, data = combined_data, subset = breakpoints (bp)$ breakpoints)

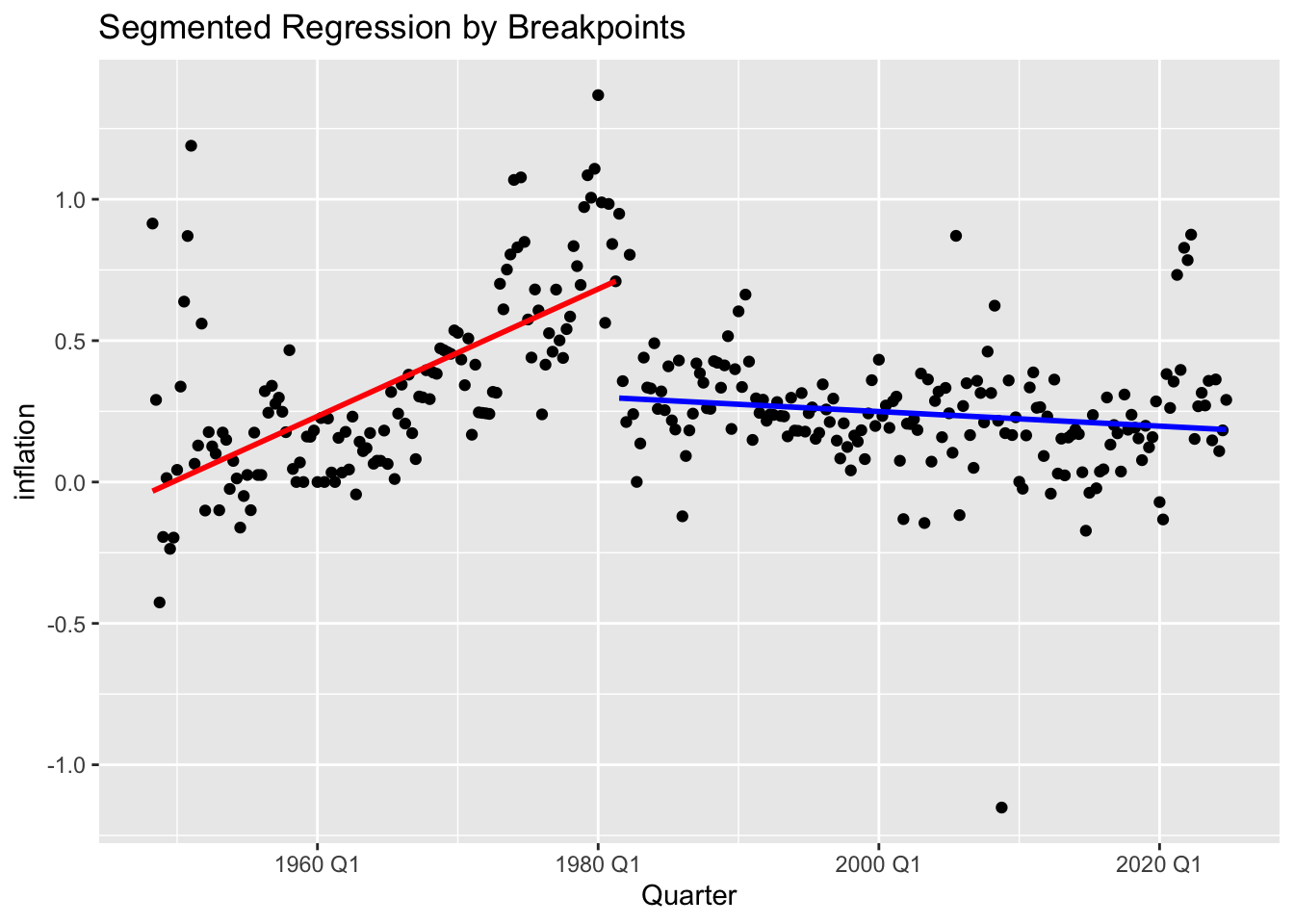

# Get breakpoint indices <- bp$ breakpoints # Split data into segments <- split (combined_data, findInterval (1 : nrow (combined_data), vec = c (0 , bp_indices)))# Fit models to each segment <- lapply (segments, function (df) {lm (inflation ~ GDP_growth + Unemployment + CPI, data = df)# Plot segmented regressions ggplot (combined_data, aes (y = inflation, x= Quarter)) + geom_point () + geom_smooth (data = segments[[1 ]], method = "lm" , se = FALSE , color = "red" ) + geom_smooth (data = segments[[2 ]], method = "lm" , se = FALSE , color = "blue" ) + labs (title = "Segmented Regression by Breakpoints" )

3. Model Analysis

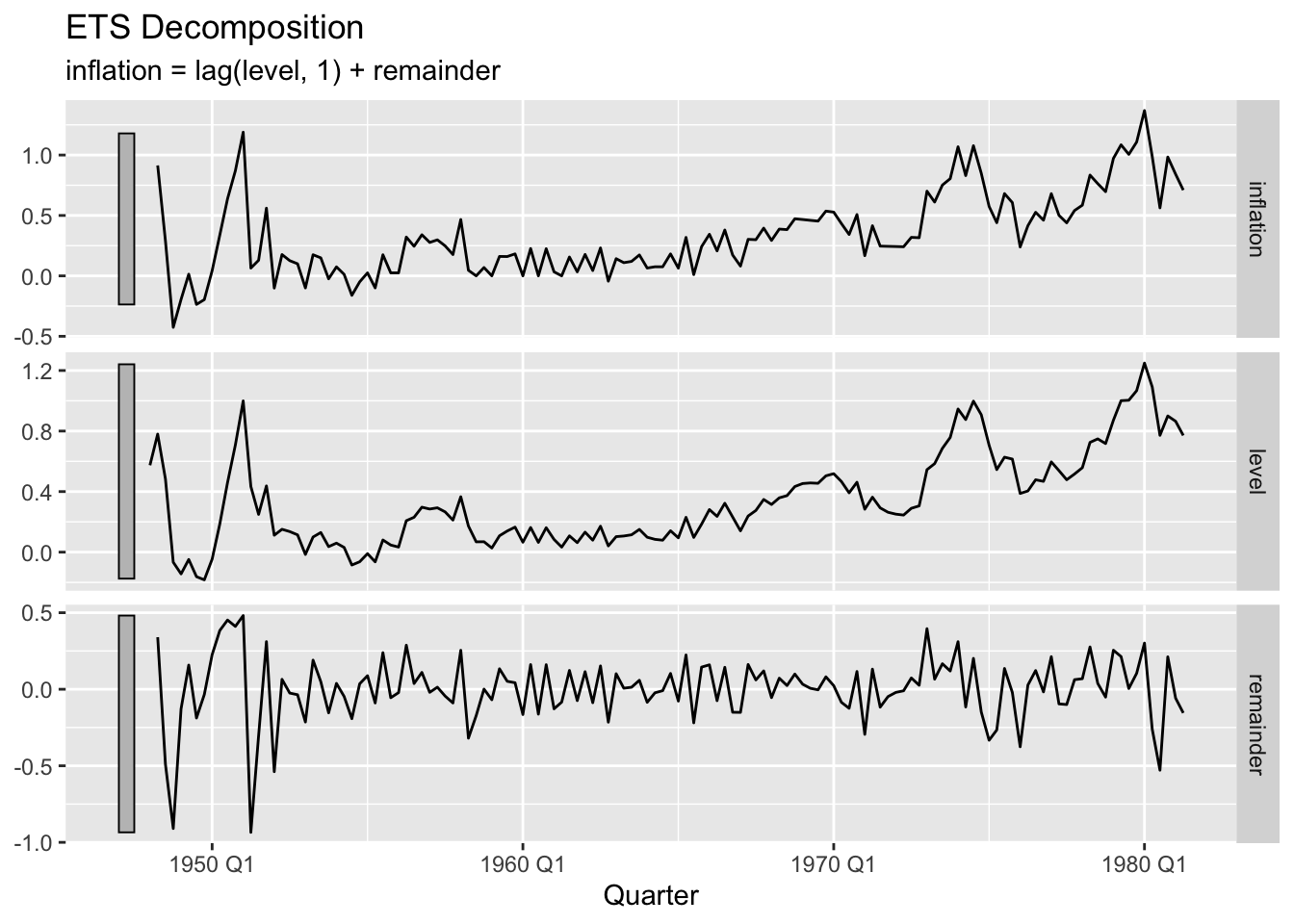

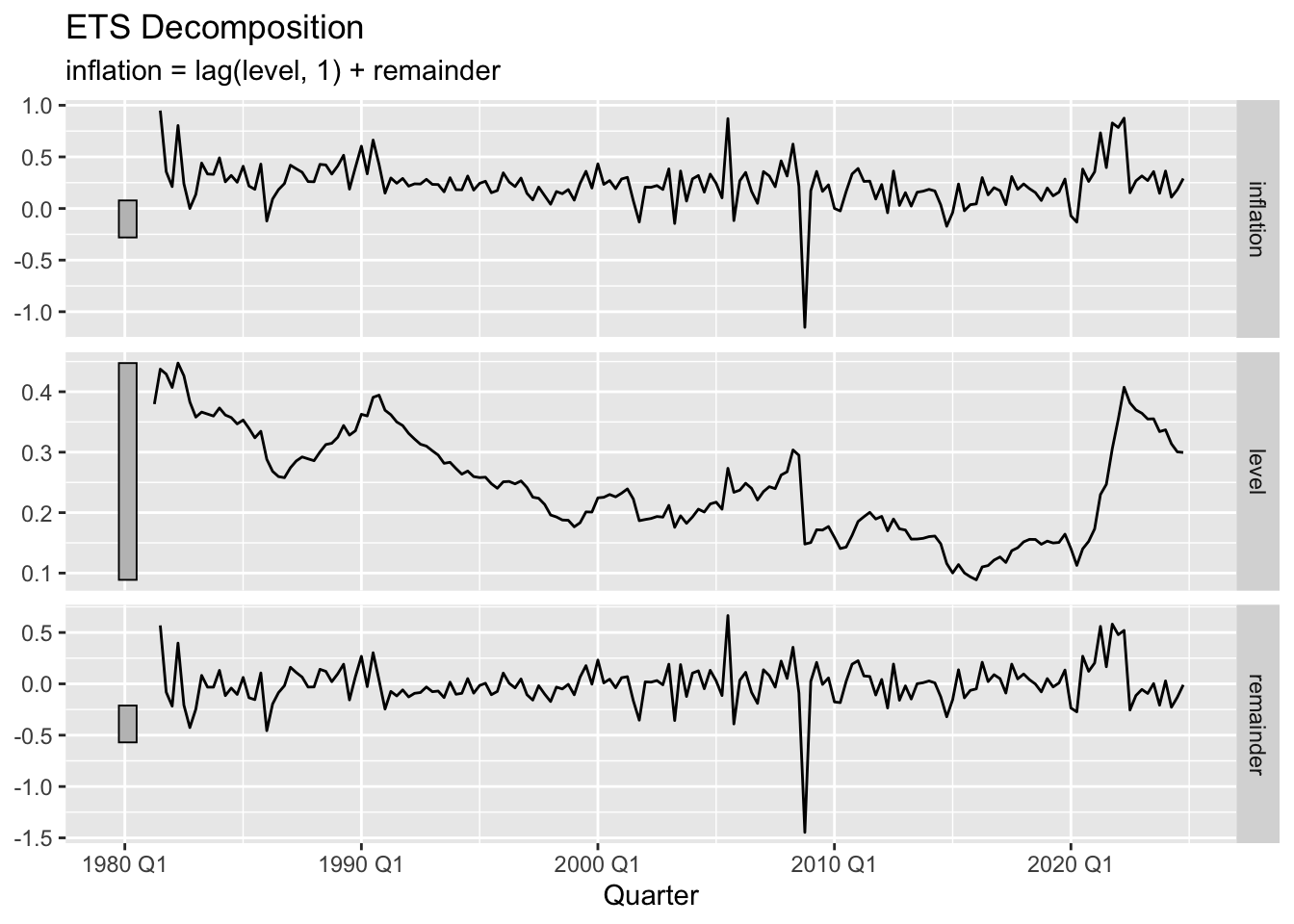

# Compare ETS components across regimes %>% compact () %>% # Remove NULL entries map (~ components (.x) %>% autoplot () + labs (title = "ETS Decomposition" ))

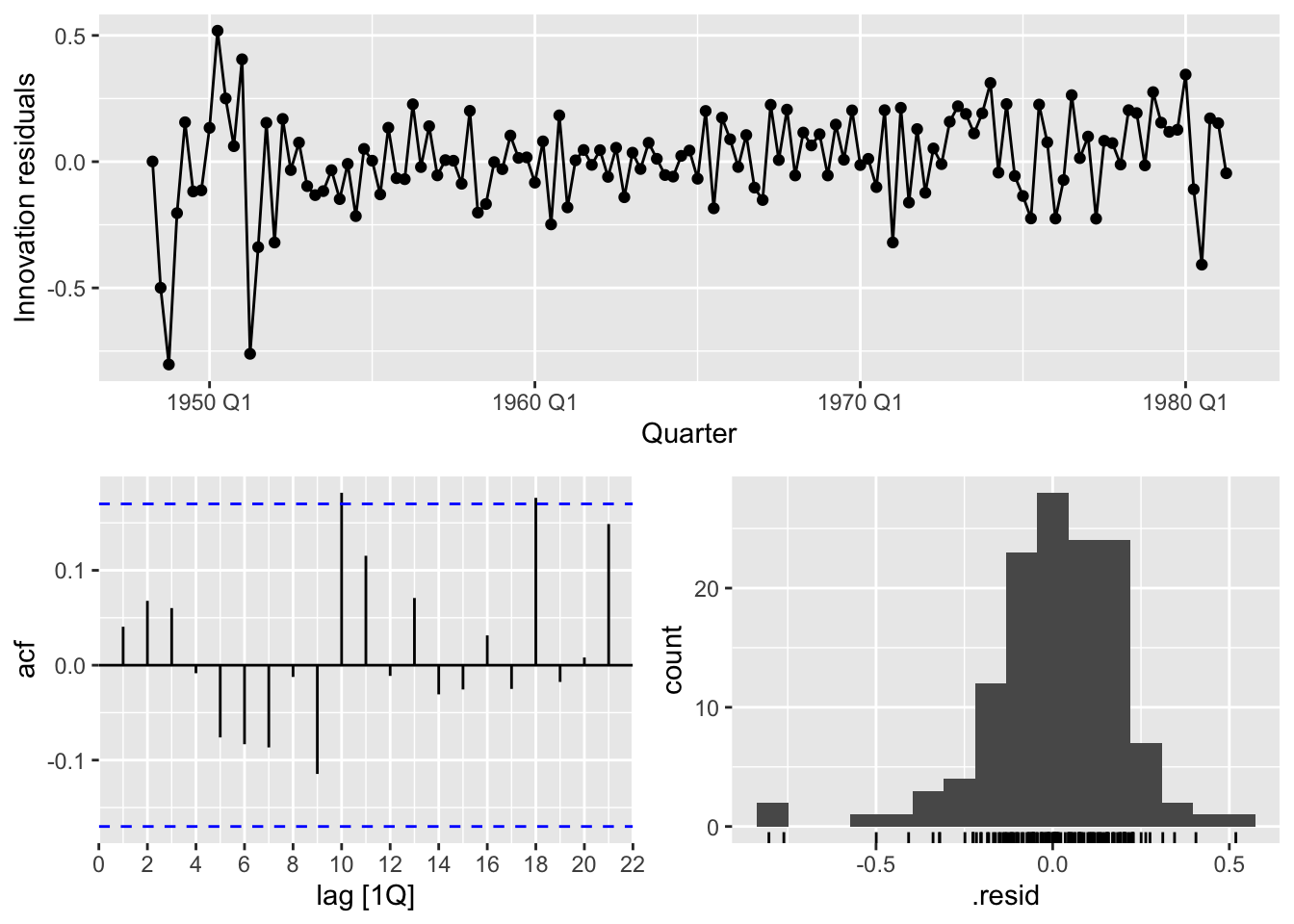

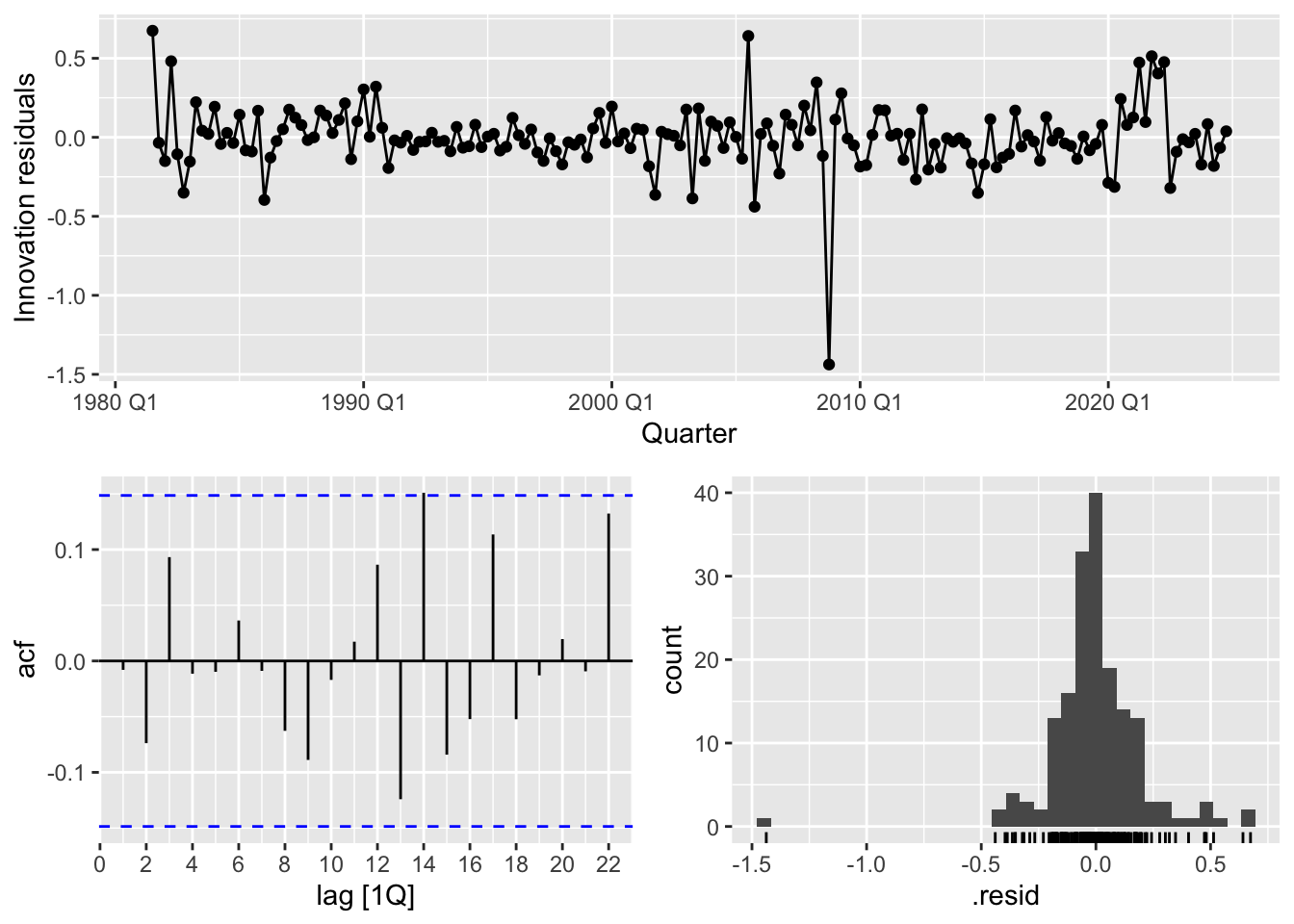

%>% compact () %>% .[[1 ]] %>% gg_tsresiduals ()%>% compact () %>% .[[2 ]] %>% gg_tsresiduals ()

# Compare VAR relationships %>% compact () %>% map (~ {tibble (Causality_GDP = causality (.x, cause = "GDP_growth" )$ Granger$ p.value,Causality_Unemp = causality (.x, cause = "Unemployment" )$ Granger$ p.value%>% knitr:: kable ()

5.203468e-06

6.306067e-14

Q: (Group Activity) What do these models tell us about different economic regimes before/after the breakpoints?

ETS

A: The analysis reveals three key regime shifts:

Volatility Changes (ETS):

Pre-break: Higher \(\alpha=0.605\) (rapid adjustment to new data)

Post-break: Lower \(\alpha=0.102\) (smoother evolution)

Implication: Inflation became more stable post-breakpoint

Structural Shifts (ARIMA):

Pre-break: Requires differencing (\(d=1\) ) with seasonal MA components

Post-break: Stationary (\(d=0\) ) with seasonal AR component

Implication: Fundamental change in inflation dynamics requiring different stabilization approaches

VAR

Causal Relationships (VAR):

Pre-break: Moderate Granger-causality (GDP→inflation p=0.017; Unemp→inflation p=0.005)

Post-break: Stronger causal links (GDP→inflation p=5.2e-6; Unemp→inflation p=6.3e-14)Implication: Post-break economic indicators became more interconnected/predictive of inflation