# Retrieve VIX data from 2000-01-01 to current date and convert to a tsibble

vix_data <- tq_get("^VIX", from = "2000-01-01",

to = "2025-01-01",

get = "stock.prices") %>%

as_tsibble(index = date)

# Clean and interpolate missing values

vix_data <- vix_data %>%

tsibble::fill_gaps() %>%

mutate(adjusted = zoo::na.approx(adjusted)) %>%

select(date, adjusted) %>%

tidyr::drop_na()Activity12

Model Selection & Diagnostic Criteria

Today, we will walk through a complete model selection exercise using VIX data. Our goals are to:

- Perform Exploratory Data Analysis (EDA) with visual diagnostics.

- Fit built-in models (ARIMA and ETS) using the

Tidyvertsframework. - Evaluate models based on five metrics: AIC, AICc, BIC, Mean Squared Error (MSE), and Root Mean Squared Error (RMSE).

- Conclude on the optimal model by comparing these metrics along with residual diagnostics and forecast performance.

For a model with \(n\) observations and \(k\) parameters (including the intercept), the evaluation criteria are defined as:

\[ \begin{align} \text{AIC} &= n\ln\left(\frac{\text{RSS}}{n}\right) + 2k,\\[1mm] \text{BIC} &= n\ln\left(\frac{\text{RSS}}{n}\right) + k\ln(n),\\[1mm] \text{AICc} &= \text{AIC} + \frac{2k(k+1)}{n-k-1}, \end{align} \]

and the error metrics:

\[ \begin{align} \text{MSE} &= \frac{\text{RSS}}{n},\\[1mm] \text{RMSE} &= \sqrt{\text{MSE}}. \end{align} \]

Data Preparation

We retrieve the VIX data and format as a tsibble, handling missing values while preserving the original adjusted price series.

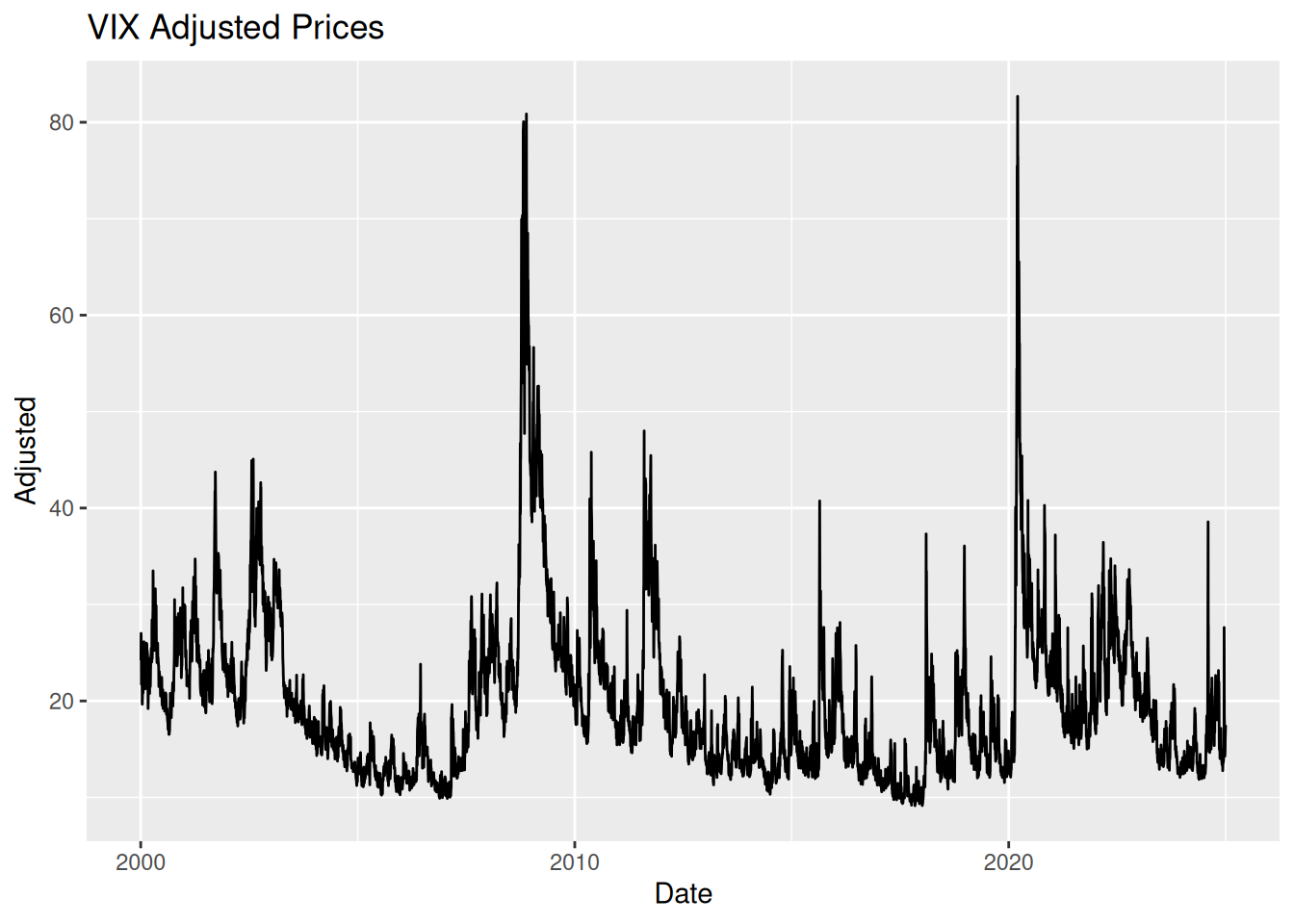

Exploratory Data Analysis (EDA)

Time Series Plot

vix_data %>%

autoplot(adjusted) +

labs(title = "VIX Adjusted Prices", y = "Adjusted", x = "Date")

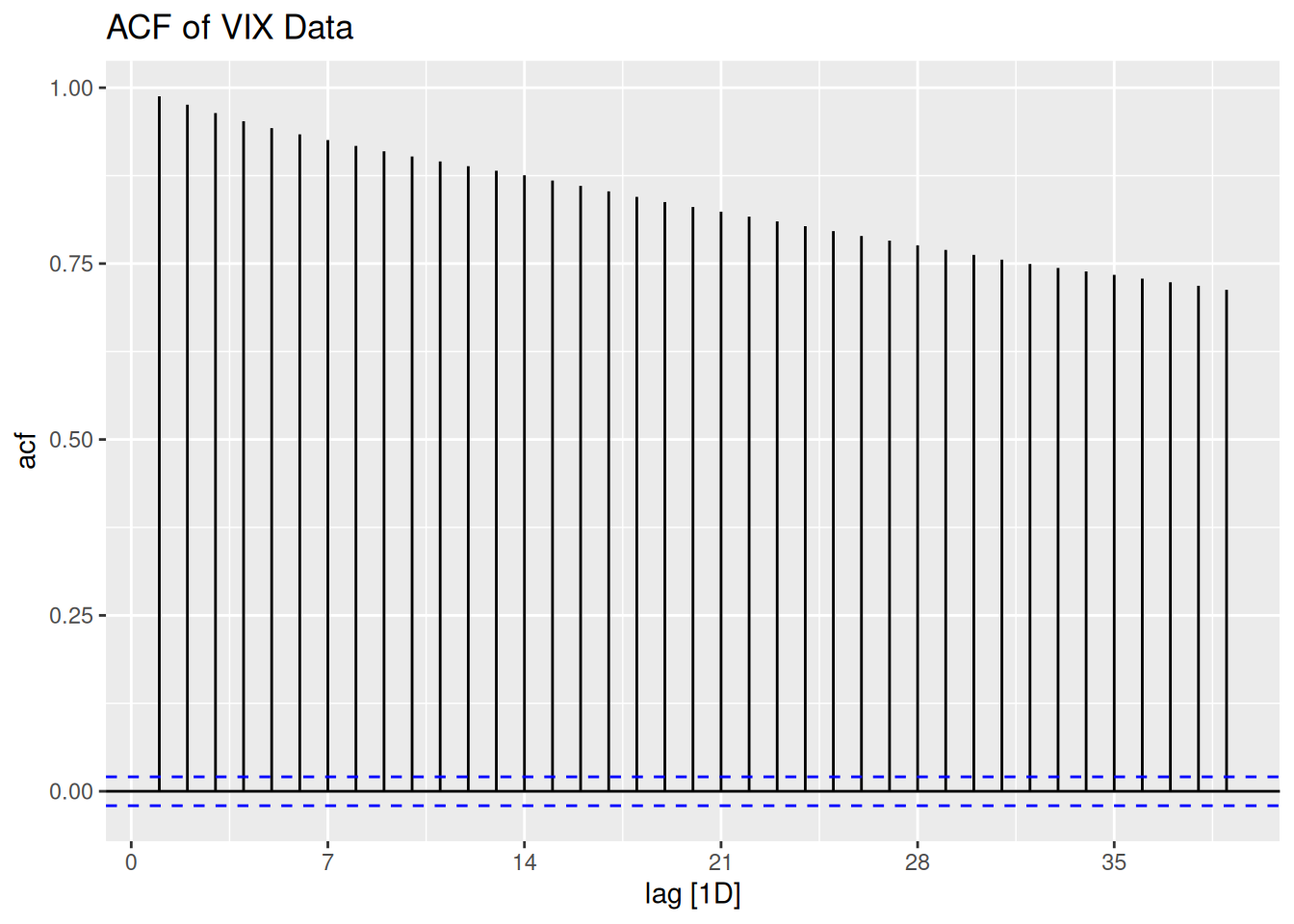

ACF and PACF Analysis

vix_data %>%

ACF(adjusted) %>%

autoplot() +

labs(title = "ACF of VIX Data")

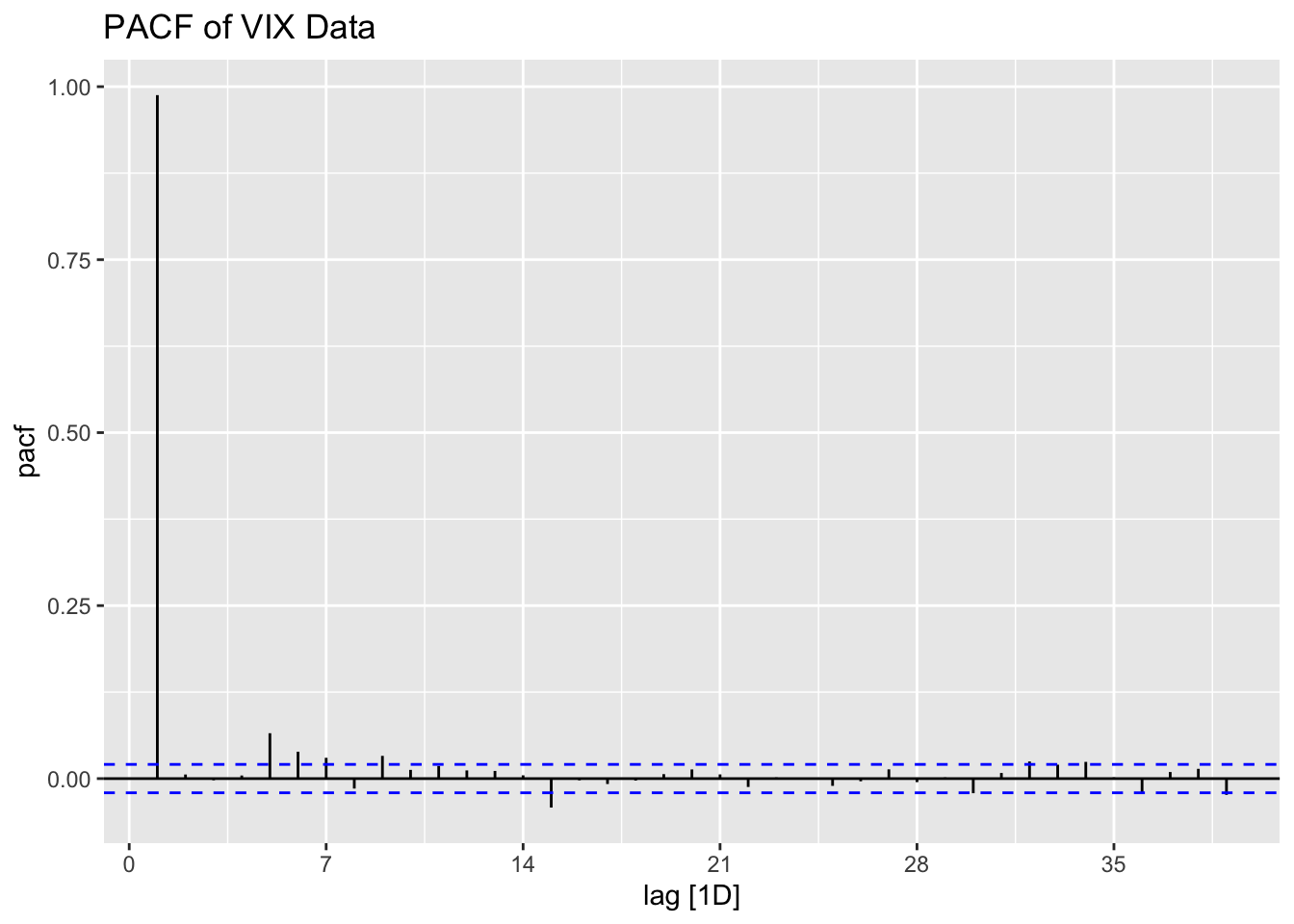

vix_data %>%

PACF(adjusted) %>%

autoplot() +

labs(title = "PACF of VIX Data")

Observation:

The persistence in ACF suggests potential need for differencing, but we’ll let ARIMA automatically handle any required transformations through its \(d\) parameter.

Model Fitting Using Tidyverts

1. ARIMA Model (Original Series)

# Fit an ARIMA model on original series

model_arima <- vix_data %>%

model(ARIMA(adjusted))

# Display summary report

report(model_arima)Series: adjusted

Model: ARIMA(3,1,1)(0,0,2)[7]

Coefficients:

ar1 ar2 ar3 ma1 sma1 sma2

0.9615 0.0082 -0.0179 -0.9811 0.0286 0.0553

s.e. 0.0168 0.0145 0.0122 0.0133 0.0115 0.0107

sigma^2 estimated as 1.728: log likelihood=-15446.52

AIC=30907.05 AICc=30907.06 BIC=30956.88# Display accuracy metrics

model_arima %>% accuracy()# A tibble: 1 × 10

.model .type ME RMSE MAE MPE MAPE MASE RMSSE ACF1

<chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 ARIMA(adjusted) Traini… -0.00181 1.31 0.731 -0.220 3.42 0.356 0.403 -2.97e-42. ETS Model

# Fit ETS model on original series

model_ets <- vix_data %>%

model(ETS(adjusted))

# Display summary report

report(model_ets)Series: adjusted

Model: ETS(M,Ad,M)

Smoothing parameters:

alpha = 0.9998863

beta = 0.0449181

gamma = 0.0001019892

phi = 0.8178318

Initial states:

l[0] b[0] s[0] s[-1] s[-2] s[-3] s[-4] s[-5]

25.49738 -0.7829361 1.00114 0.9990668 0.9956332 1.002539 0.9994978 0.9996608

s[-6]

1.002462

sigma^2: 0.003

AIC AICc BIC

83569.41 83569.45 83661.96 # Display accuracy metrics

model_ets %>% accuracy()# A tibble: 1 × 10

.model .type ME RMSE MAE MPE MAPE MASE RMSSE ACF1

<chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 ETS(adjusted) Training -0.000342 1.32 0.732 -0.120 3.43 0.356 0.405 -0.0392Forecasting with the Optimal Model

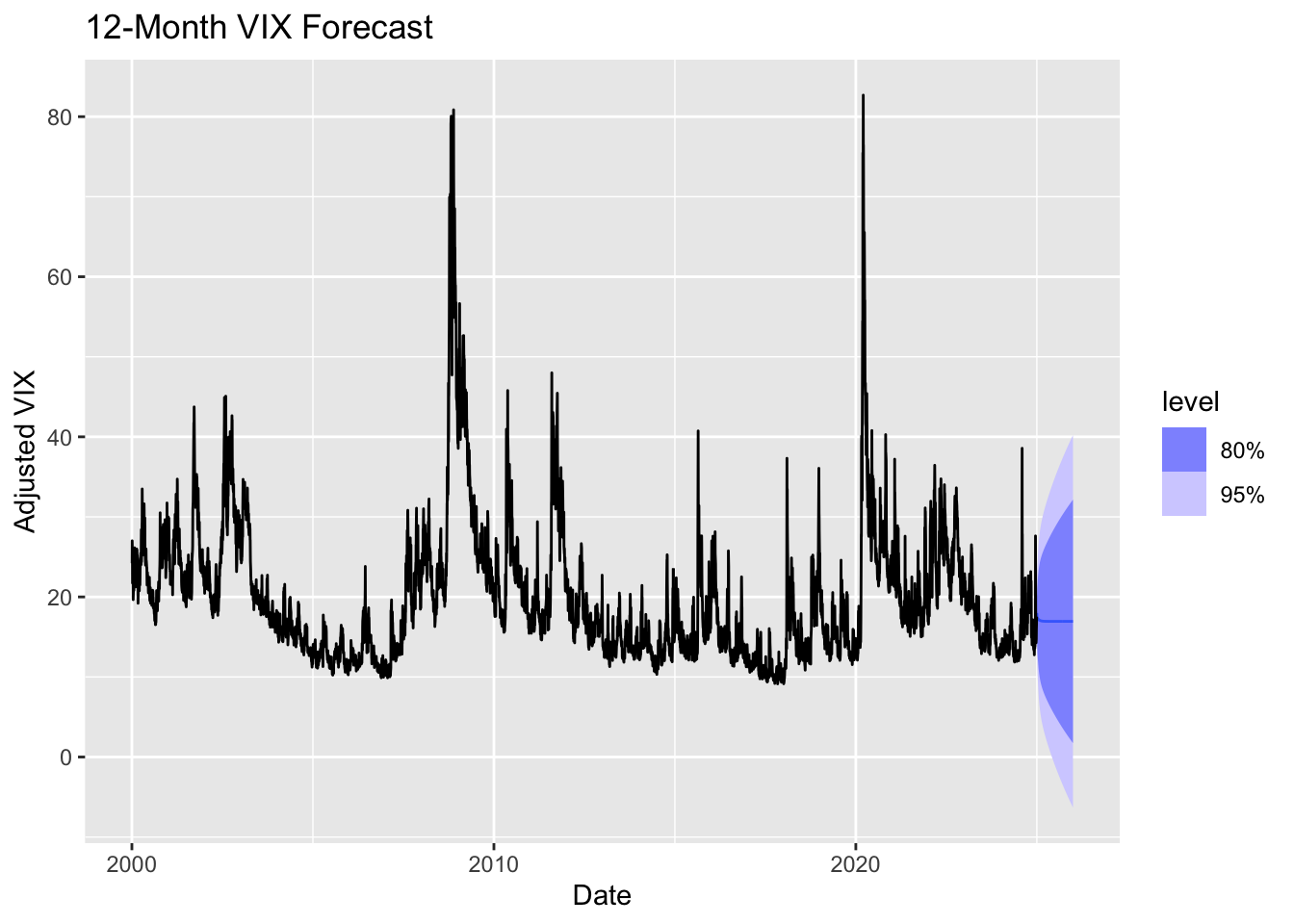

# Forecast 12 months ahead using ARIMA

forecast_arima <- model_arima %>%

forecast(h = "12 months")

# Plot forecast in original units

forecast_arima %>%

autoplot(vix_data) +

labs(title = "12-Month VIX Forecast", y = "Adjusted VIX", x = "Date")

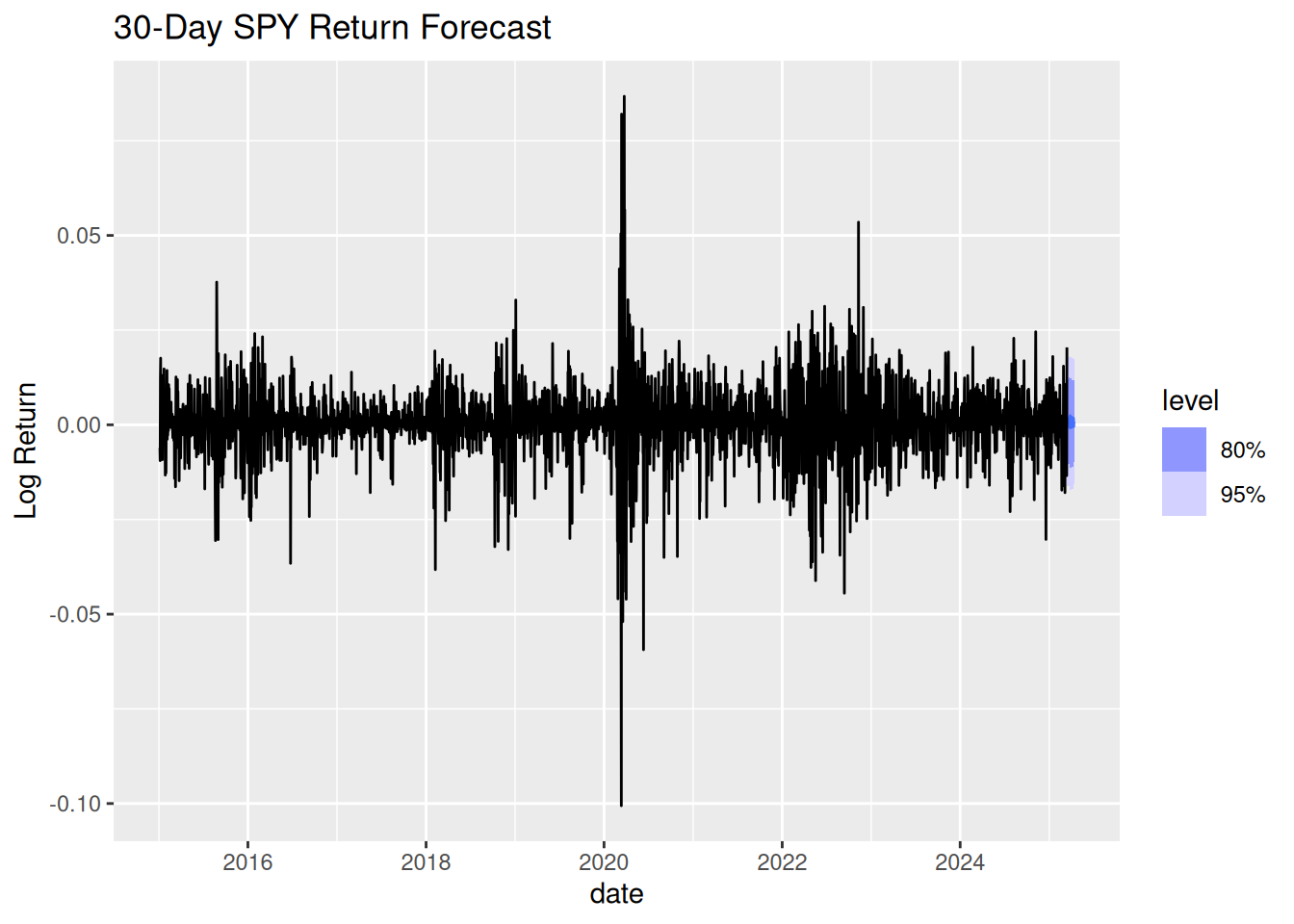

Lab Activity: Modeling Stock Returns with ARIMA

Model daily SPY returns using ARIMA, analyze residuals, and compare with ETS.

Tasks

- Retrieve SPY data (2015-01-01 to present) and compute daily log returns

- Perform EDA (time series plot, ACF/PACF)

- Fit ARIMA(2,0,1) and ETS models to returns

- Compare models using AIC and RMSE

- Forecast 1-month ahead returns

Solution

# Task 1: Data Preparation

spy_data <- tq_get("SPY", from = "2015-01-01") %>%

as_tsibble(index = date) %>%

tsibble::fill_gaps() %>%

mutate(adjusted = na.approx(adjusted),

log_return = difference(log(adjusted))) %>%

select(date, adjusted, log_return) %>%

tidyr::drop_na()

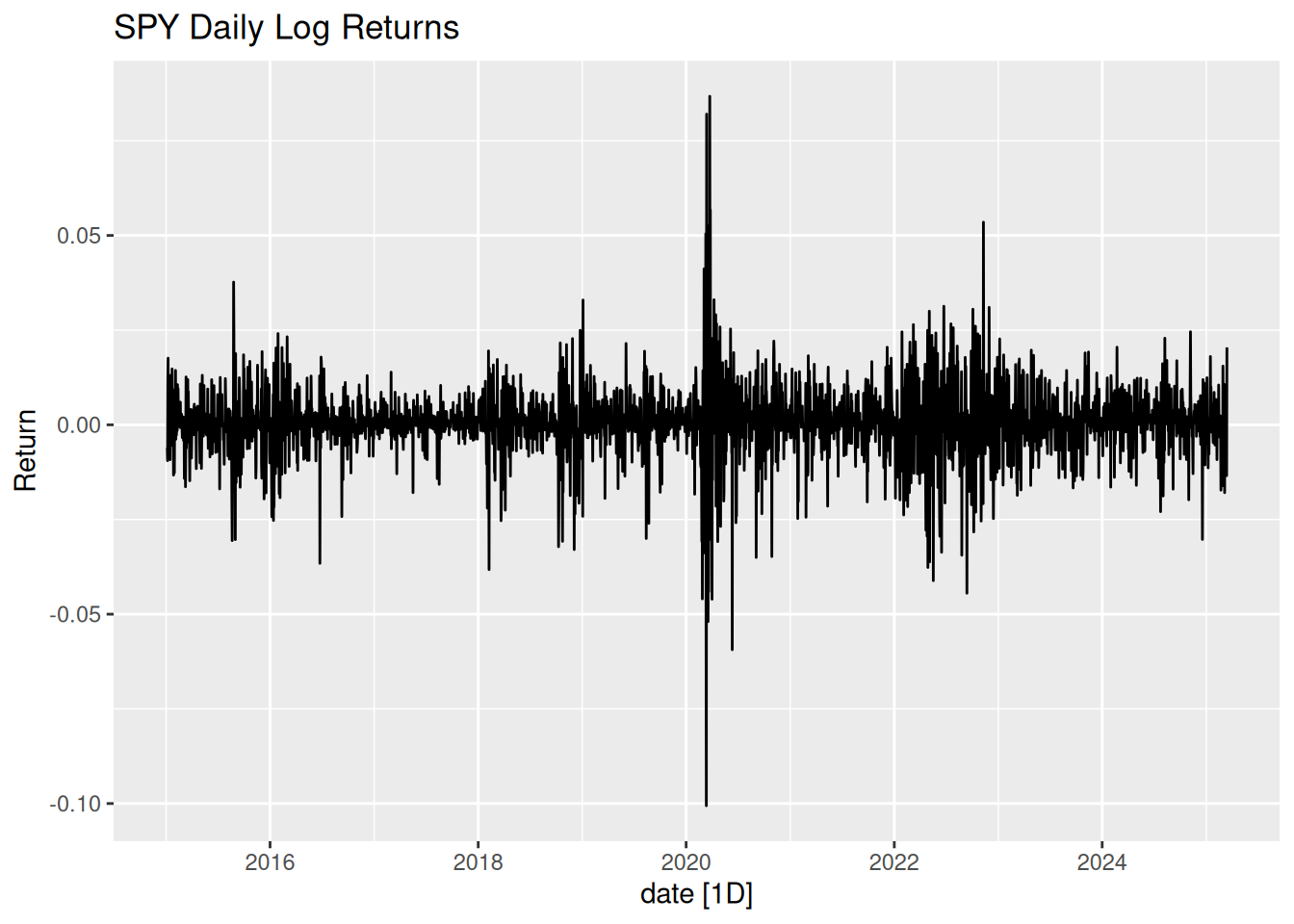

# Task 2: EDA

spy_data %>% autoplot(log_return) +

labs(title = "SPY Daily Log Returns", y = "Return")

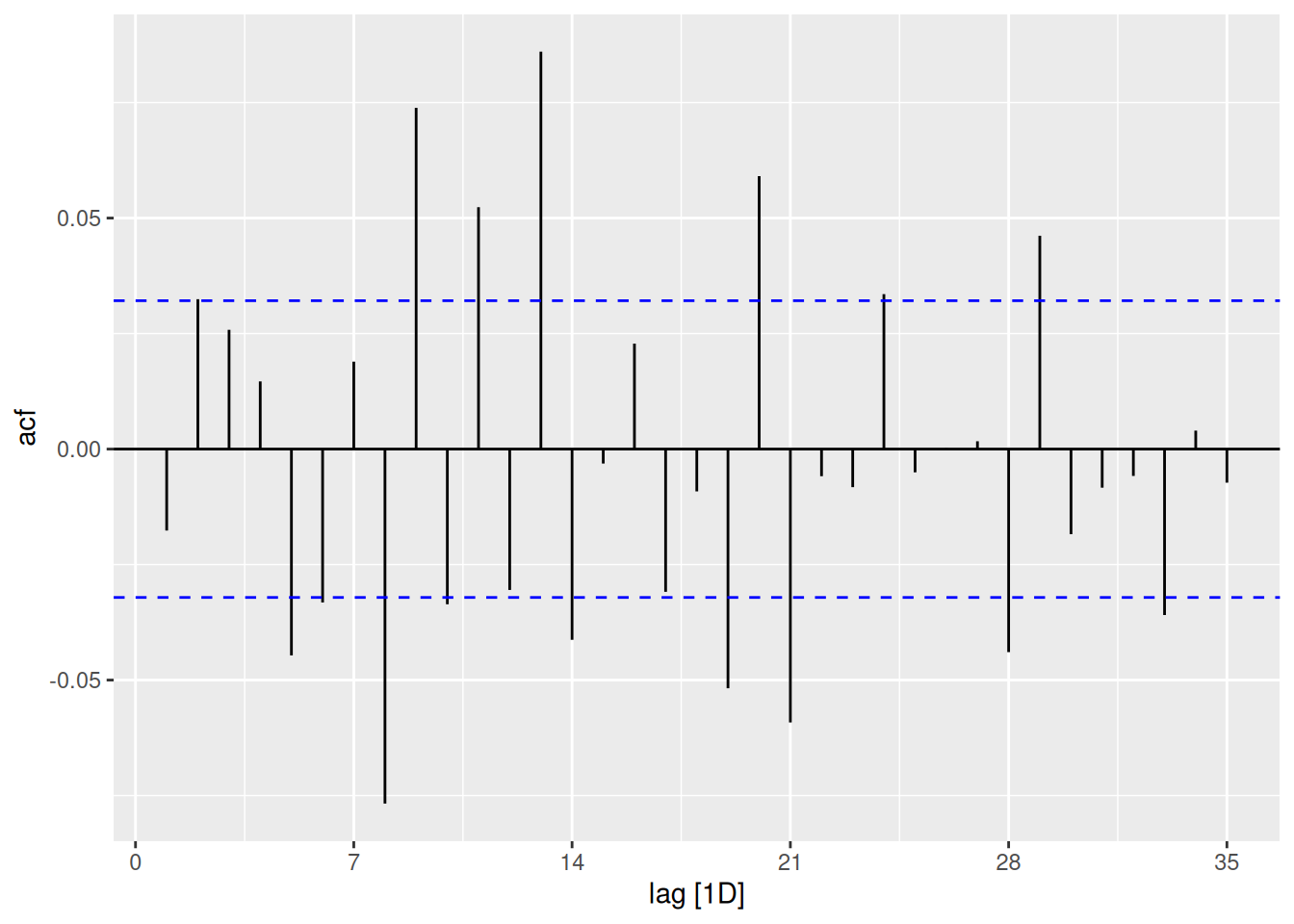

spy_data %>% ACF(log_return) %>% autoplot()

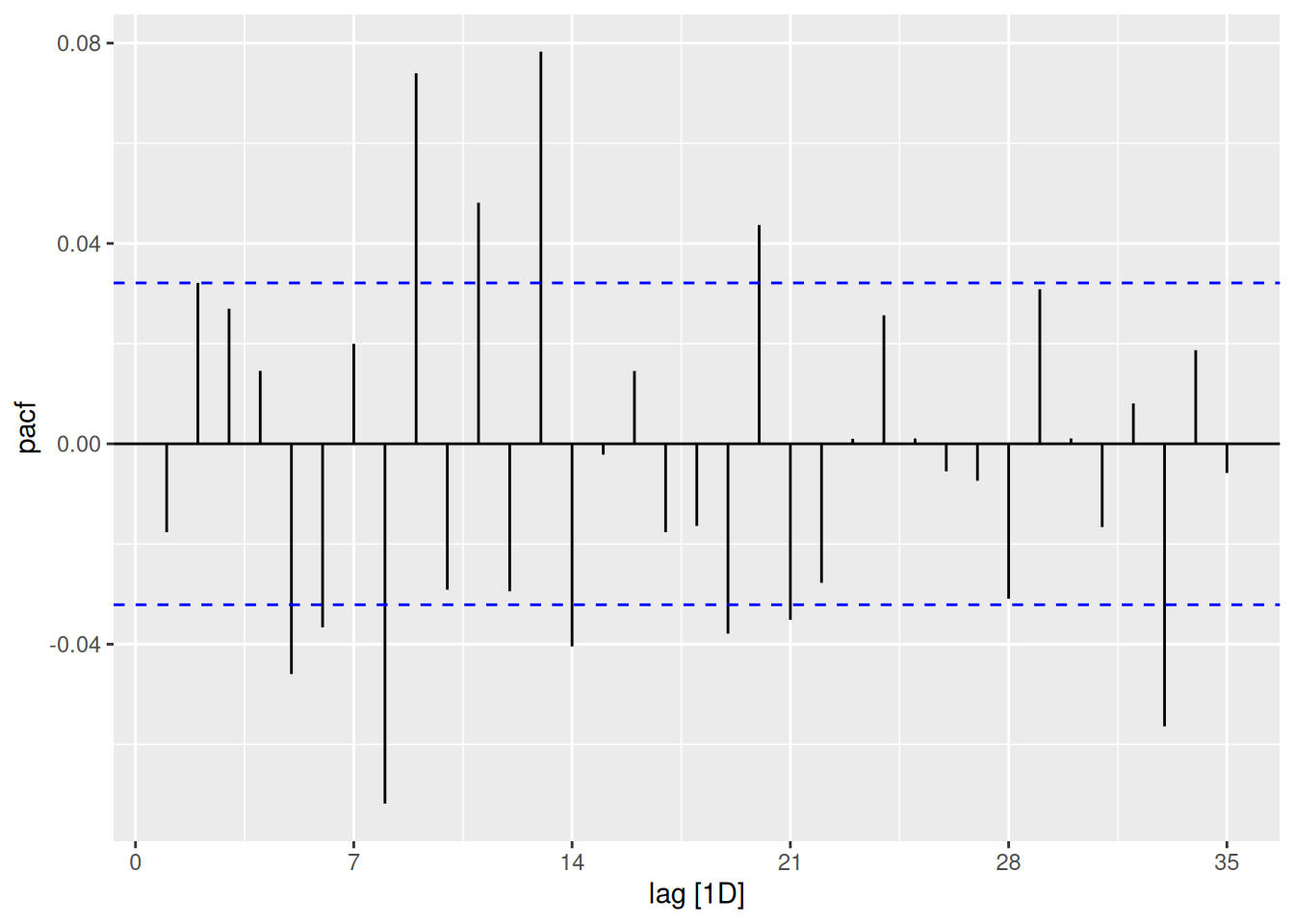

spy_data %>% PACF(log_return) %>% autoplot()

# Task 3: Model Fitting

fit_arima <- spy_data %>%

model(ARIMA(log_return ~ pdq(2,0,1)))

fit_ets <- spy_data %>%

model(ETS(log_return))

# Task 4: Model Comparison

glance(fit_arima) %>% select(AIC, AICc, BIC)# A tibble: 1 × 3

AIC AICc BIC

<dbl> <dbl> <dbl>

1 -24976. -24976. -24926.glance(fit_ets) %>% select(AIC, AICc, BIC)# A tibble: 1 × 3

AIC AICc BIC

<dbl> <dbl> <dbl>

1 -4714. -4714. -4695.accuracy(fit_arima)# A tibble: 1 × 10

.model .type ME RMSE MAE MPE MAPE MASE RMSSE ACF1

<chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 ARIMA(log_ret… Trai… -6.56e-7 0.00866 0.00511 NaN Inf 0.697 0.722 -4.23e-4accuracy(fit_ets)# A tibble: 1 × 10

.model .type ME RMSE MAE MPE MAPE MASE RMSSE ACF1

<chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 ETS(log_return) Train… 1.60e-6 0.00870 0.00509 -Inf Inf 0.695 0.726 -0.0305# Task 5: Forecasting

fit_arima %>%

forecast(h = 30) %>%

autoplot(spy_data) +

labs(title = "30-Day SPY Return Forecast", y = "Log Return")